Apartment completions plunge 40 per cent creating supply crisis as units now outperform houses in Perth, Adelaide and Brisbane markets driven by scarcity rather than abundance.

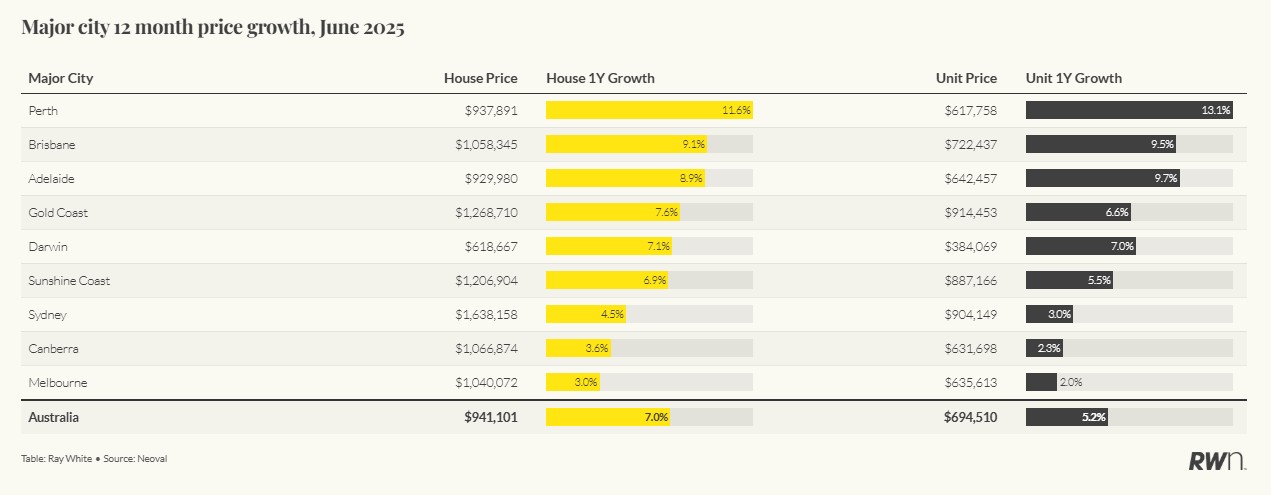

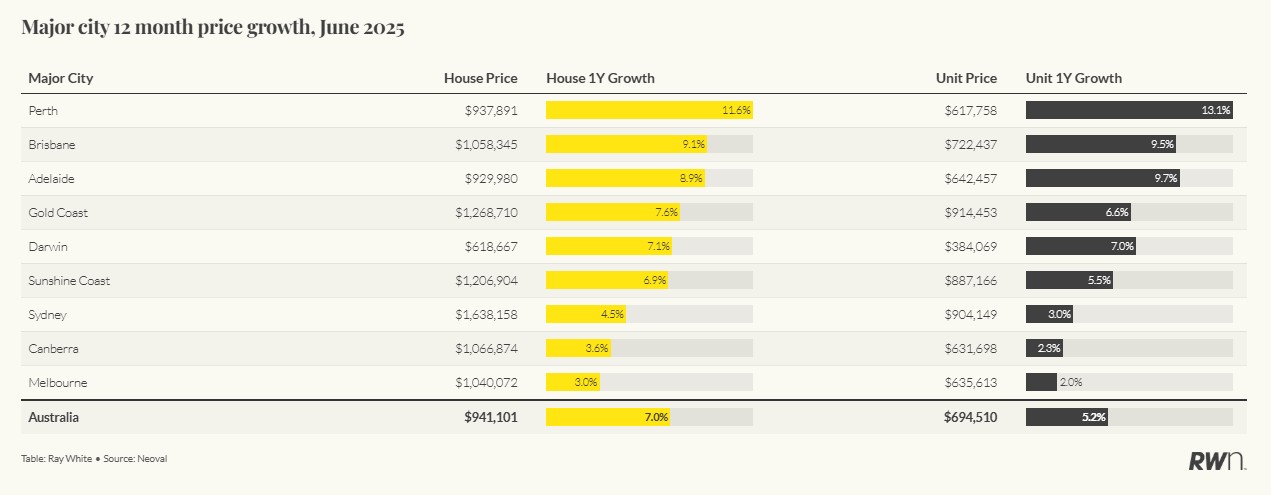

Australia’s apartment markets are experiencing an unprecedented phenomenon, with units now outperforming houses in the nation’s three strongest markets, driven by a perfect storm of chronic undersupply and a development pipeline skewed heavily toward luxury projects. Perth units are surging ahead with 13.1 per cent annual growth compared to 11.6 per cent for houses, Adelaide apartments deliver 9.7 per cent against 8.9 per cent for houses, and Brisbane units edge past houses with 9.5 per cent growth – but this outperformance masks a deeper crisis in apartment supply and affordability.

The fundamental issue is that hardly any apartments are being built, particularly in the affordable or mid-market segments that once provided accessible housing options. When new apartment projects do proceed, they’re predominantly luxury developments targeting premium buyers, pushing median unit prices steadily upward. This creates a vicious cycle: as affordable apartment supply dwindles, competition intensifies for existing stock, driving prices higher and making units outperform houses not through abundance, but through scarcity.

Perth exemplifies this dynamic perfectly. With units now costing $618,000 compared to $938,000 for houses, apartments appear to offer a 66 per cent discount. Apartment prices are however growing at a faster rate. Both segments are experiencing acute supply shortages, with apartment construction particularly constrained by elevated development costs and land prices that have risen over 75 per cent since 2020. New apartment projects that do proceed focus on premium segments where margins can absorb these inflated costs, leaving the mainstream market undersupplied.

Adelaide demonstrates the longest-running impact of this supply shortage, with units outperforming houses since July 2024 across 12 consecutive months. Brisbane’s more recent unit outperformance, beginning in early 2025, reflects the same pattern spreading to additional markets. The geographic concentration of this phenomenon – notably absent in Queensland’s coastal markets – confirms it’s specifically tied to acute supply-demand imbalances rather than broader market strength.

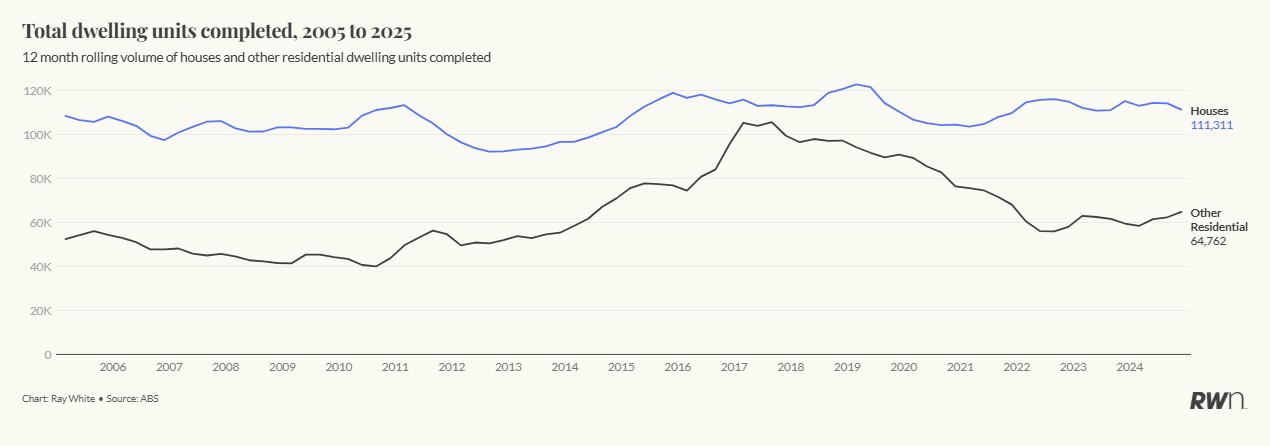

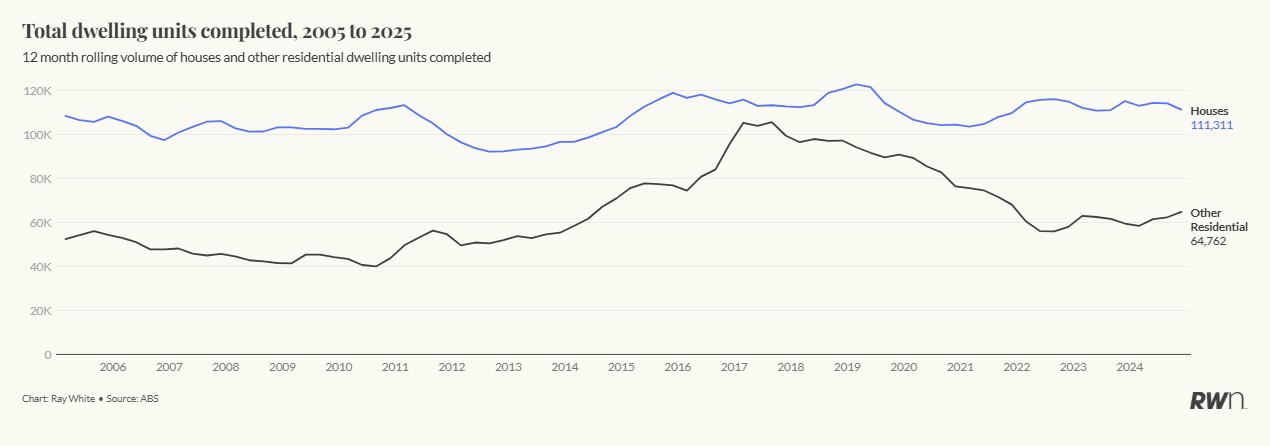

The apartment supply crisis is starkly illustrated by construction completion data, which shows apartment deliveries have plummeted by over 40 per cent from their peak. Australia completed approximately 75,000 apartments in 2024, down from a peak of over 125,000 units in 2016. Annual apartment completions have collapsed from over 97,000 in 2018 to just 58,913 in 2023, though 2024 showed a modest recovery to 64,869 units – still 33 per cent below peak levels. This supply drought explains why units are outperforming houses despite their traditional role as the more affordable option. With apartment construction operating at barely two-thirds of peak capacity while demand intensifies, the fundamental supply-demand equation has shifted dramatically.

The construction industry’s inability to deliver affordable apartments is creating artificial scarcity that drives price growth. Development sites that once supported diverse apartment projects now struggle to make economic sense except for luxury developments. Construction costs that remain 30-40 per cent above pre-pandemic levels, combined with development site prices at record highs, mean that new apartment supply is increasingly concentrated in premium segments where higher sale prices can justify elevated development costs.

This supply constraint is reshaping buyer behaviour across all market segments. First-time buyers who once relied on affordable apartment options find themselves competing for limited stock, driving up prices. Established buyers seeking to downsize or invest face similar supply shortages, particularly in markets where new apartment construction has virtually ceased outside luxury segments. The result is that units outperform houses not because apartments are abundant and affordable, but because they’re increasingly rare and expensive.

Monthly growth data reinforces this scarcity-driven momentum. Perth units advancing 1.4 per cent monthly and Adelaide and Brisbane units both growing 1.0 per cent monthly reflect intense competition for limited stock rather than healthy market dynamics. Even regional areas are experiencing this phenomenon, with Regional WA and Regional SA recording 1.8 per cent monthly unit growth as supply shortages spread beyond capital cities.

Looking ahead, this unit outperformance trend signals fundamental structural problems. Without meaningful increases in affordable apartment construction – constrained by persistently high development costs and land prices – the current scarcity-driven growth may continue, making apartments increasingly unaffordable for the very buyers they once served.