Will the RBA drop rates this year?

With the US having cut interest rates, speculation is rife as to whether Australia will (and should) follow. Underlying inflation in Australia sat at 3.9%, down from a peak of 6.8% back in December 2022. It shows the monetary policy management adopted by the RBA has been effective.

One thing to note on the US Fed dropping rates, is that their cash rate is much higher than Australia’s sitting at 4.75% – 5.00%, and it’s the first time the US has cut rates in four years. Australia only started its upward rate trajectory in May 2022.

Many experts and analysts believe Australia will begin seeing interest rate reductions from February 2025.

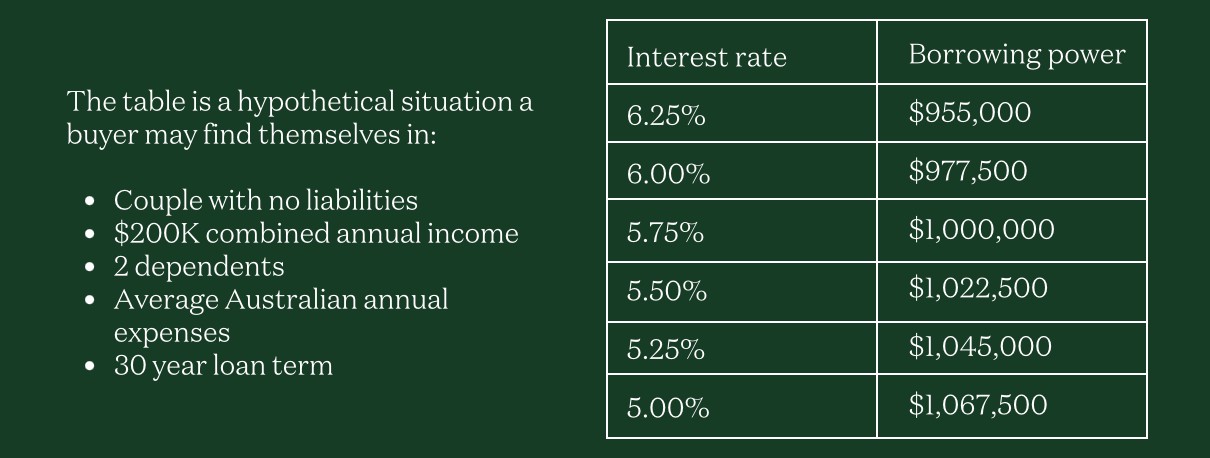

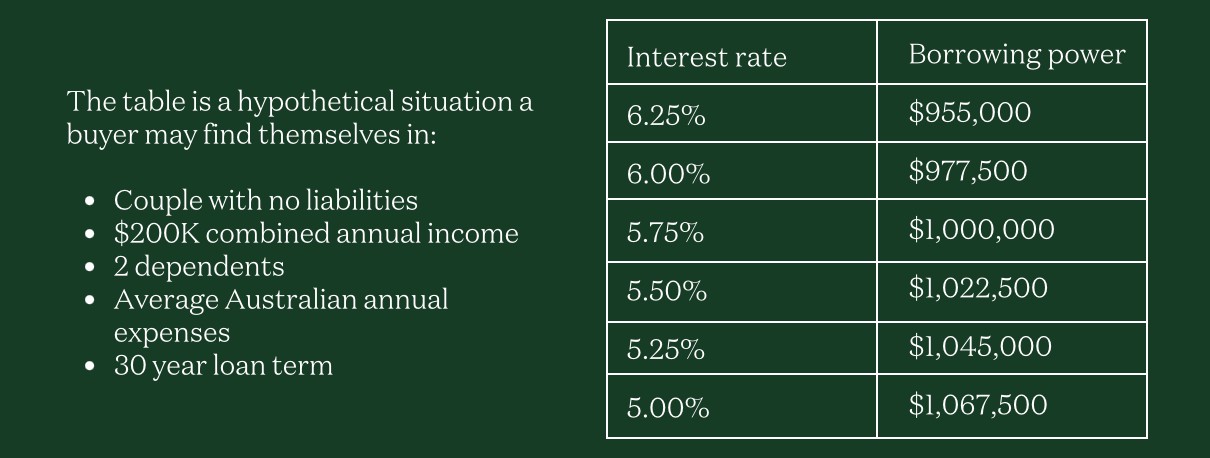

When rates do start coming down again, the good news for borrowers is that borrowing power goes up. This means borrowers are able to lend more without having to increase their incomes or reduce other debt/expenditure.

In Greater Melbourne in particular this is timely, as the median house price has been dropping over recent months and will mean buyer budgets will stretch further with increased borrowing and lower property prices.

The cash rate is currently 4.35% and the average variable rate home loan sits around 6.20%. Below, we’ve put together a handy table to show how much borrowing power increases as interest rates decrease:

If you’re keen to buy property over the next 12 months, get in touch with the Entourage team. We can model out a range of different scenarios based on different rates and serviceability factors to allow you to make an informed decision to meet your budget and goals.

We are also seeing some cash backs making a bit of a comeback at the moment, with a few lenders offering some enticing deals to encourage new borrowers to refinance their way.

Source: Vinnie Moore, Entourage