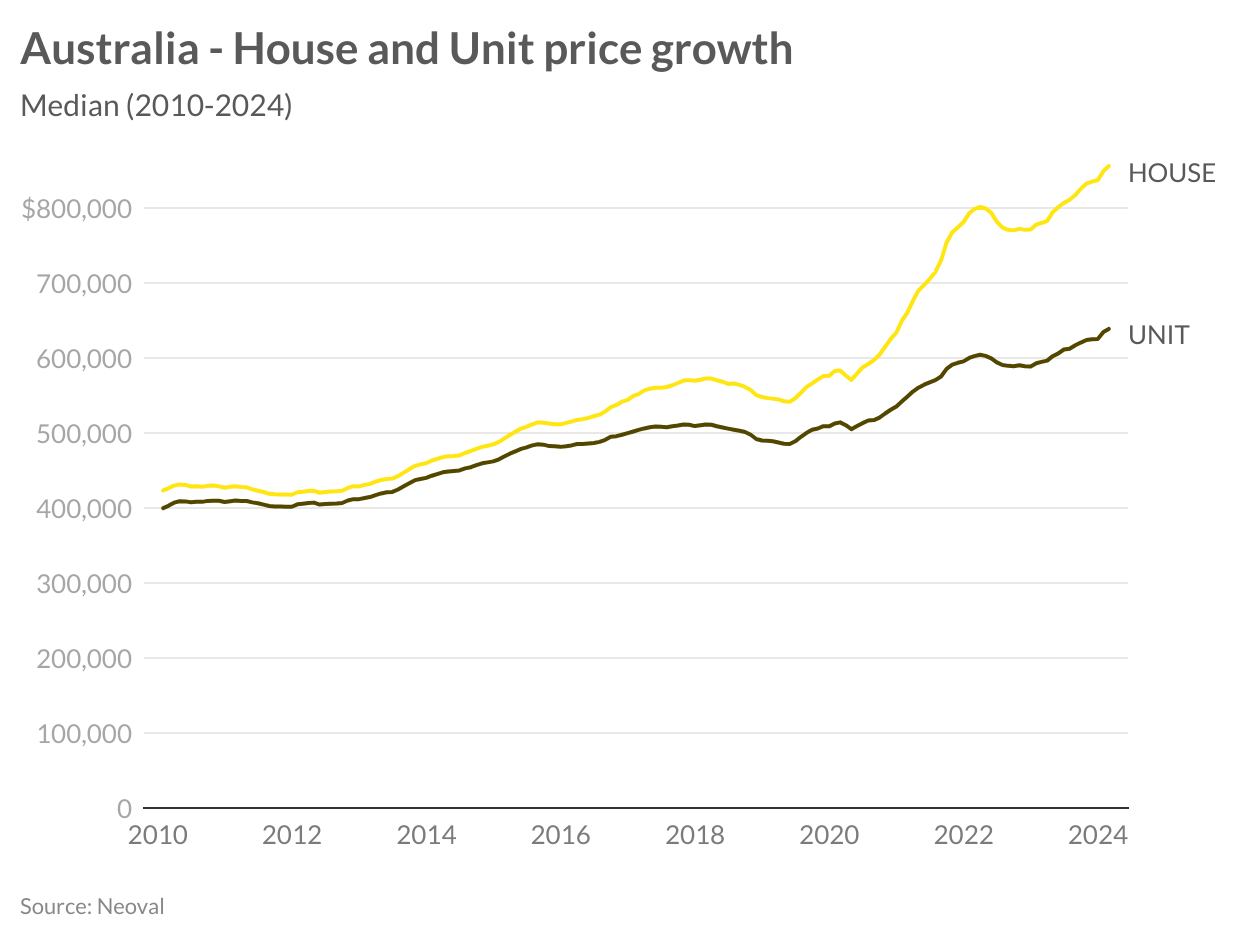

It has been a strong start to 2024 for Australian housing markets with house prices up already 2.2 per cent. If this rate of growth continues, it is possible that Australian house prices will increase more than 10 per cent this year. Fundamentally, there are many reasons why the outlook for house prices will be stronger than last year.

Over the past 12 months, house prices have increased by 9.7 per cent while unit prices are up 7.4 per cent. However, growth has accelerated quickly in the first two months of this year. And while last year was characterised by strong price growth in smaller cities, so far this year, it is Sydney and Melbourne.

The drivers of price growth have been well documented. Population growth was extremely strong last year and we didn’t build enough homes. In 2023, we needed 250,000 new homes but built only 175,000. The pipeline is looking even worse. Over the past 12 months there have only been 163,000 homes approved. Even in a more normal construction environment, not all of these homes will be built. Conditions are slowly improving in the construction sector but they won’t be solved this year. Population growth will ease this year, but so too will the number of new homes built.

The big change this year is the interest rate outlook. Monthly inflation came in at 3.4 per cent in the year to January. With the Reserve Bank of Australia aiming for interest rates at between 2-3 per cent, the odds of a rate cut are rising. So much so that as of last week, markets were pricing in three cuts over the next 12 months.

A major driver of price growth last year were strong conditions in our smaller cities. Population growth drove up south-east Queensland prices while a combination of rising wealth and population growth increased prices in resource-rich states such as Western Australia and South Australia. Comparatively, Melbourne and Sydney were a lot slower given their greater sensitivity to interest rate changes. This year, it is likely to switch.

The outlook for price growth is a problem for affordability. Unfortunately, rising construction costs have made building new homes far more expensive and this price growth of existing homes has to occur to make buying new homes relatively cost effective. Right now, many people, particularly first home buyers, are being pushed into the established home market given it’s cheaper to buy than build.

However, it’s still only early 2024 and a lot can change, but if current house price trends continue this year, house price growth could exceed 10 per cent, with units increasing slightly less. The cities that will increase the most are Sydney, Melbourne and Canberra. However, smaller cities will continue to see increases, with regional Victoria seeing the lowest growth.

Source: https://bit.ly/3Tfy8bZ