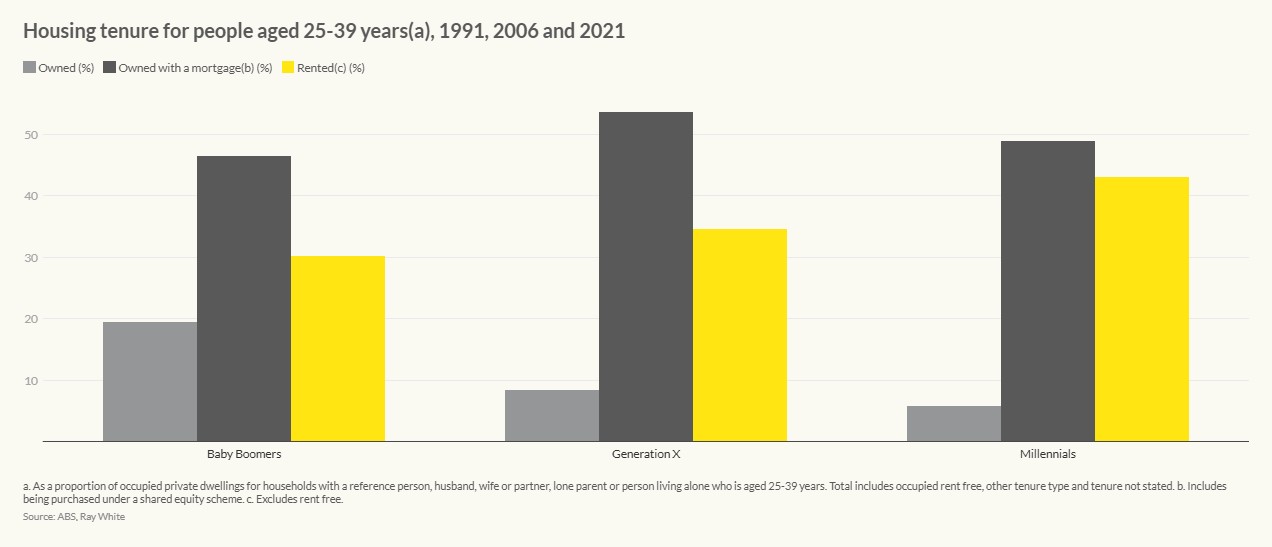

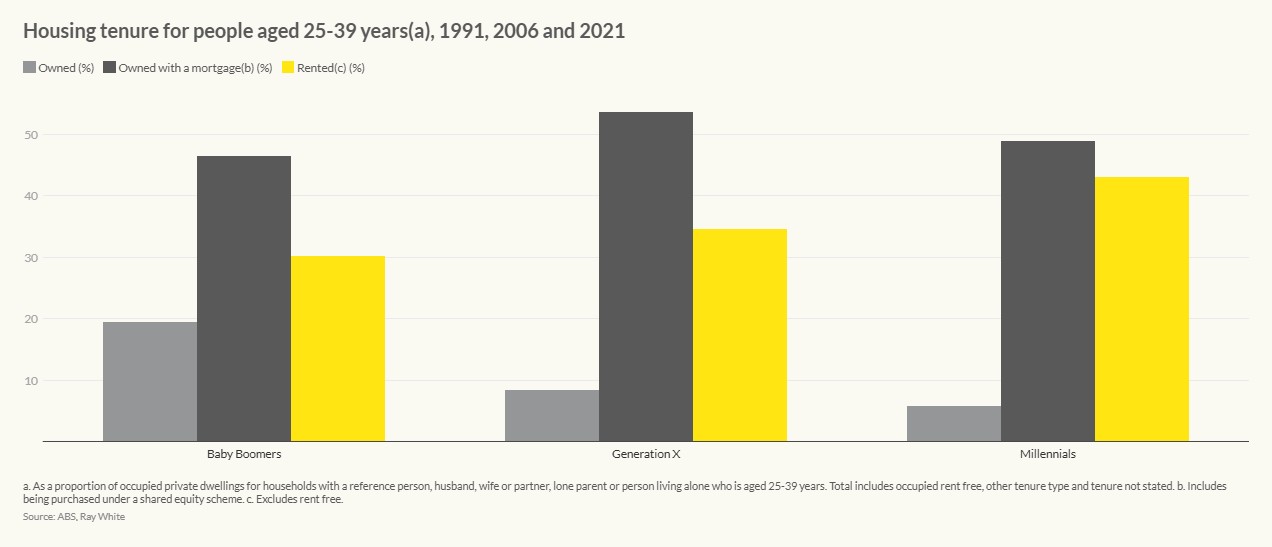

Only 55 per cent of millennials aged between 25-39 own their home, compared to 70 per cent of baby boomers at the same age in 1991 and 65 per cent of Gen X in 2006. This dramatic shift reflects more than just affordability challenges – it represents a fundamental change in how young Australians must approach homeownership.

The housing tenure data reveals a concerning trend: while outright ownership has remained relatively stable across generations, the proportion of young people with mortgages has declined significantly. More telling is the rise in rental accommodation among millennials, with over 40 per cent renting compared to around 30 per cent for previous generations at the same age. This shift indicates that many young Australians are either unable to secure mortgage finance or are choosing to delay homeownership due to market conditions.

The traditional path of saving for a deposit while living at home, then buying in the same city where you work, has become increasingly unviable. In 1991, capital city homeownership was achievable for many young adults as affordable housing meant they could accumulate a deposit by the time they were ready to establish independence. Today’s market demands a completely different strategy.

Rentvesting has emerged as the pragmatic response to this new reality. Remarkably, over 50 per cent of property investment purchases in the past year were made by millennials and Gen Z, according to Commonwealth Bank data. This strategy allows buyers to purchase an investment property in an affordable area while continuing to rent in their preferred location – maintaining lifestyle while building equity.

The strategic advantage

The appeal of rentvesting extends beyond simple affordability. It offers genuine strategic advantages that traditional homeownership cannot match. Young professionals can live in vibrant inner-city areas with superior amenities, shorter commutes, and dynamic social scenes while building wealth through property investment in growth markets.

This approach also provides career flexibility. Rather than being anchored to one location by a mortgage, rentvestors can relocate for career opportunities while maintaining their investment portfolio. The psychological pressure of homeownership – being responsible for every repair, rate rise, and market fluctuation on your primary residence – is also reduced.

The financial mechanics work particularly well in Australia’s current market conditions. Investment property loans, while requiring higher deposits and carrying slightly higher interest rates, offer significant tax advantages through negative gearing and depreciation benefits. These tax efficiencies can substantially improve the investment’s net return.

Choosing your strategy

Successful rentvesting requires choosing between two primary approaches, each suited to different investor profiles and market conditions.

Capital gains strategy

This approach focuses on suburbs showing potential for significant capital appreciation. The objective is straightforward: when it comes time to sell, the difference between purchase and sale price helps bridge the gap between your budget and your desired home price.

Capital gains investors typically target suburbs at the beginning of medium-term appreciation cycles. Current market conditions favour areas experiencing population growth, infrastructure development, or economic transformation.

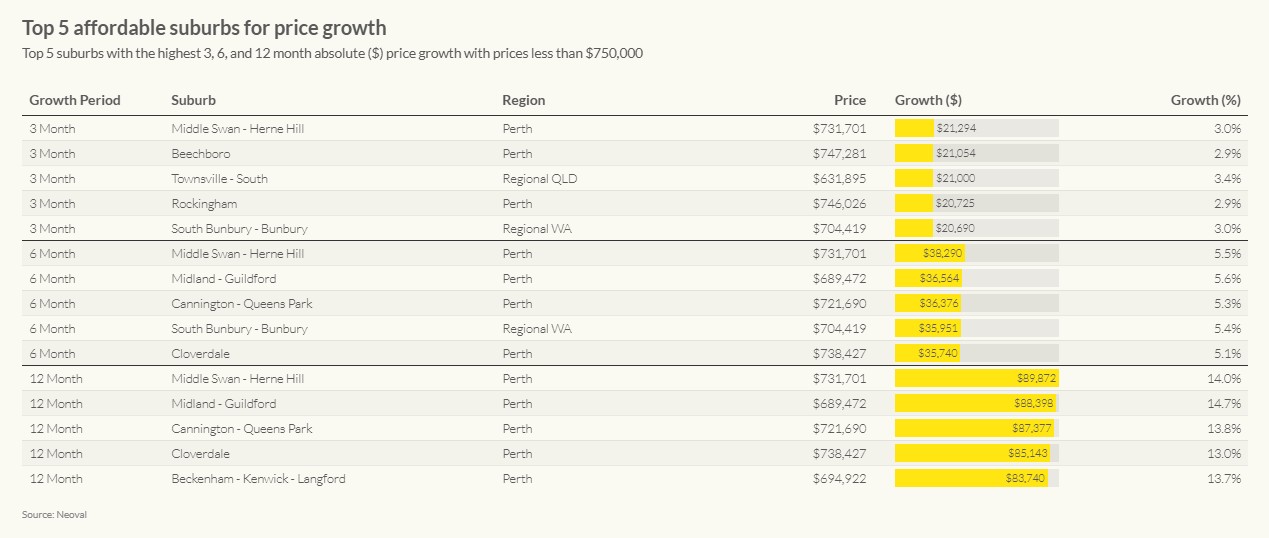

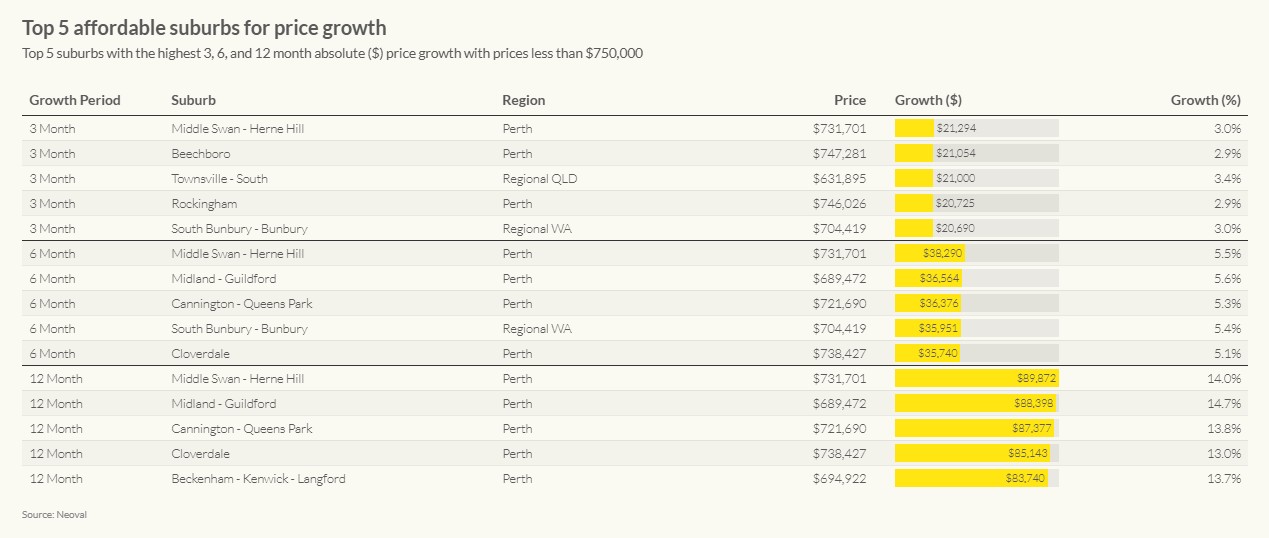

The data supports this approach, with Perth dominating the top-performing affordable suburbs for price growth. Areas like Middle Swan-Herne Hill have recorded impressive gains of over $20,000 in three months alone, representing a growth rate of 3 per cent. What’s particularly striking is that these growth suburbs maintain median prices below $750,000, making them accessible to first-time investors while still delivering substantial capital appreciation.

Perth’s market dominance extends across multiple timeframes, with suburbs like Harrisdale, Cloverdale, and Cannington appearing consistently in both three-month and twelve-month growth lists. This sustained performance reflects the underlying economic drivers mentioned earlier: population expansion, mining sector wealth, and rising construction costs making existing homes relatively attractive.

However, capital gains investing requires patience and market timing expertise. Properties in growth areas often provide modest rental returns initially, requiring investors to contribute additional funds to cover mortgage shortfalls. This strategy suits investors with stable incomes and longer investment horizons.

High rental yield strategy

The yield-focused approach prioritises immediate cash flow, targeting suburbs where rental returns are substantial. This strategy appeals to investors preferring reliable income streams and those wanting to use additional cash flow to accelerate their savings for future property purchases.

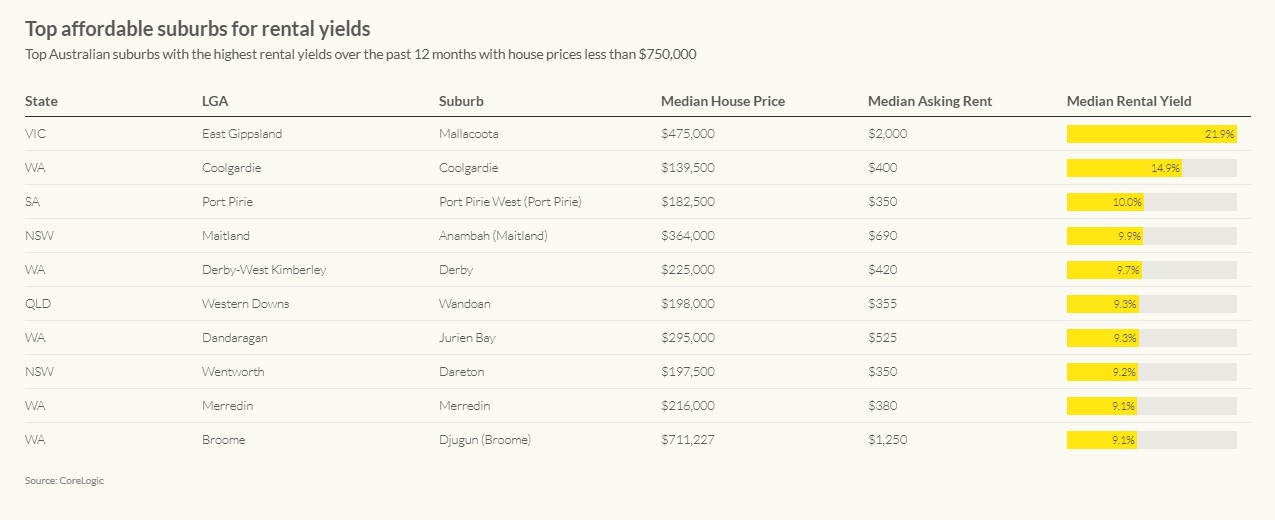

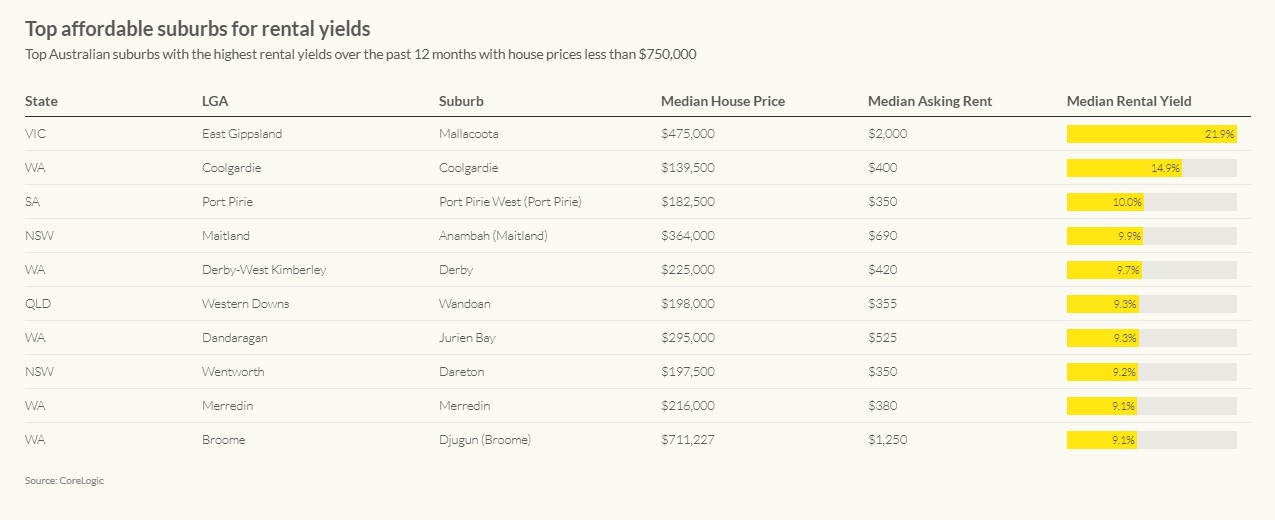

High-yield properties typically exist in regional centres, areas with specific employment anchors, or locations where housing demand exceeds supply. The current market data reveals some exceptional opportunities, with Mallacoota in East Gippsland Victoria leading the nation with a remarkable 21.9 per cent rental yield, though this likely reflects the area’s unique tourism-driven rental market and limited property supply.

More sustainable high-yield opportunities appear in regional centres like Coolgardie in Western Australia (14.2 per cent yield) and Port Pirie in South Australia (10.6 per cent yield). These areas typically offer yields driven by genuine rental demand from local employment, though investors must carefully assess the economic sustainability of these employment drivers.

Mining towns often provide exceptional yields due to worker accommodation needs, though these markets carry volatility risks tied to commodity cycles. The challenge with yield-focused investing lies in identifying sustainable high-yield markets. Some areas offer attractive returns due to economic distress or declining populations—these represent value traps rather than investment opportunities. Successful yield investors focus on markets with genuine rental demand drivers and stable economic fundamentals.

The hybrid approach

Many successful rentvestors adopt a balanced strategy, targeting suburbs offering moderate capital growth potential alongside reasonable rental yields. This approach reduces risk while providing both income support and wealth accumulation.

The rental yield data reveals interesting patterns across different states and property price points. While the highest yields often come from very regional or specialised markets, there are opportunities in the 6-10 per cent yield range that may offer better long-term stability. Areas like Derby in Western Australia or Wandoan in Queensland provide solid yields of around 9 per cent while maintaining more diversified local economies.

Hybrid markets often exist in established regional centres with diverse economies, growing populations, and reasonable infrastructure. These areas typically offer more predictable returns than extreme capital gains markets while providing better long-term wealth building than pure yield plays.

Managing the risks

Rentvesting carries inherent risks that require careful management. Vacancy periods can severely impact cash flow, particularly for negatively geared properties. Property management responsibilities add complexity and cost, while market volatility can affect both rental income and capital values.

Capital gains tax implications also require consideration. Investment properties don’t qualify for the principal residence exemption, meaning profits are subject to capital gains tax upon sale. However, this can be partially offset by the 50 per cent discount for assets held longer than 12 months.

The emotional challenge of being a landlord while remaining a tenant shouldn’t be underestimated. Dealing with difficult tenants, maintenance issues, and vacancy periods while paying rent elsewhere requires both financial buffer and psychological resilience.

Making it work

Successful rentvesting requires meticulous planning and ongoing management. Investment property loans typically require 20 per cent deposits compared to five to 10 per cent for owner-occupiers, meaning higher upfront capital requirements.

Geographic diversification offers protection against localised market downturns. Investing in different states or regions from where you live can provide portfolio balance, though it requires greater research and potentially higher management costs.

Regular portfolio reviews are essential. Annual assessments of rental yields, capital growth, and market conditions help determine when to hold, sell, or acquire additional properties. Many successful rentvestors transition to owner-occupier status within five to ten years, using accumulated equity to purchase in their preferred location.

The market reality

With historically low vacancy rates, potential interest rate cuts, and continued high population growth, Australian capital city property markets will likely remain challenging for traditional first-home buyers. Rentvesting provides a pathway to property ownership that acknowledges current market realities while building long-term wealth.

The strategy isn’t suitable for everyone. It requires higher initial capital, greater risk tolerance, and more complex financial management than traditional homeownership. However, for young Australians priced out of their preferred locations, rentvesting offers a viable alternative to indefinite renting or compromising on lifestyle.