It isn’t a bad time to be a first home buyer at the moment. Prices have come back a lot since last year making property more affordable. Meanwhile, it has become a lot more difficult to find a rental property and if you can find one, it is now a lot more expensive to be a renter. Unemployment remains at a 50-year low and we are seeing wages growth across many sectors.

There are however a number of challenges. The first is that getting finance is a lot harder and more expensive. The second is that there aren’t many properties for sale and the third is that buying a new home has become a lot more expensive.

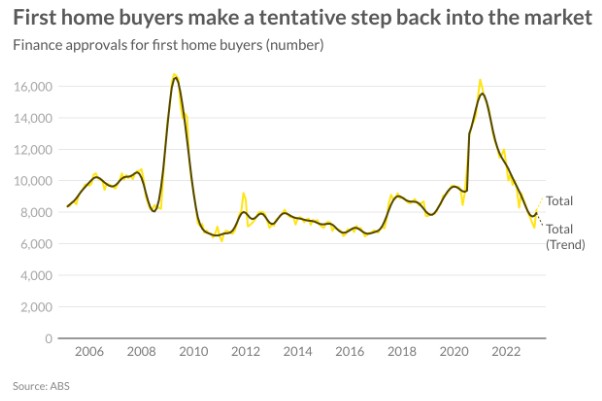

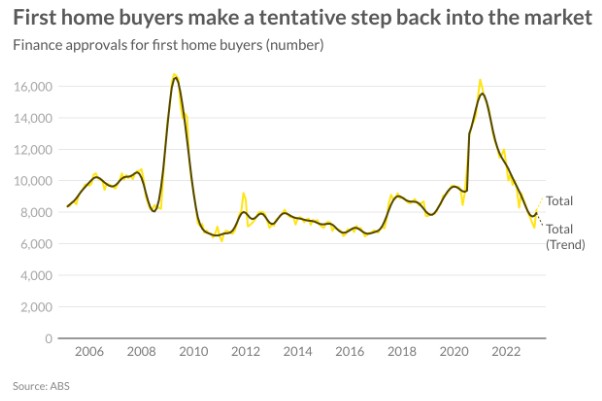

However, more first-home buyers are overcoming these challenges and returning to the market. After hitting an almost record high in January 2021, the number of first-home buyers more than halved. However, in March we saw a tentative return with the number increasing by 15 per cent in one month. The number of first-home buyers is still very low, but they seem to be returning.

Leading the charge is New South Wales. The number of first home buyers has been increasing since the start of the year, coinciding almost exactly with the market recovery which also started in January. South Australia is also seeing strong increases with the number back to where they were mid-last year.

The budget measures announced last week provided additional help for first home buyers with the extension of the First Home Buyer Guarantee scheme. Not only were additional funds provided to the scheme but it was expanded to allow for first home buyers to purchase a home with someone who isn’t a romantic partner such as a friend or other family member. The extension of the scheme reflects the changing nature of households and will be an additional help for anyone trying to get into the market.