Once the crown jewel of Australia’s real estate scene, Victoria’s property market has hit a rough patch. The state that was previously setting the pace for the nation’s property development is now lagging behind, grappling with the consequences of what many are calling an overzealous tax regime.

It wasn’t long ago that Victoria, particularly Melbourne, was the place to be for property investors and developers. Last decade, VIctoria accounted for the largest share of homes being built. This building boom transformed the cityscape and provided much-needed housing for a growing population.

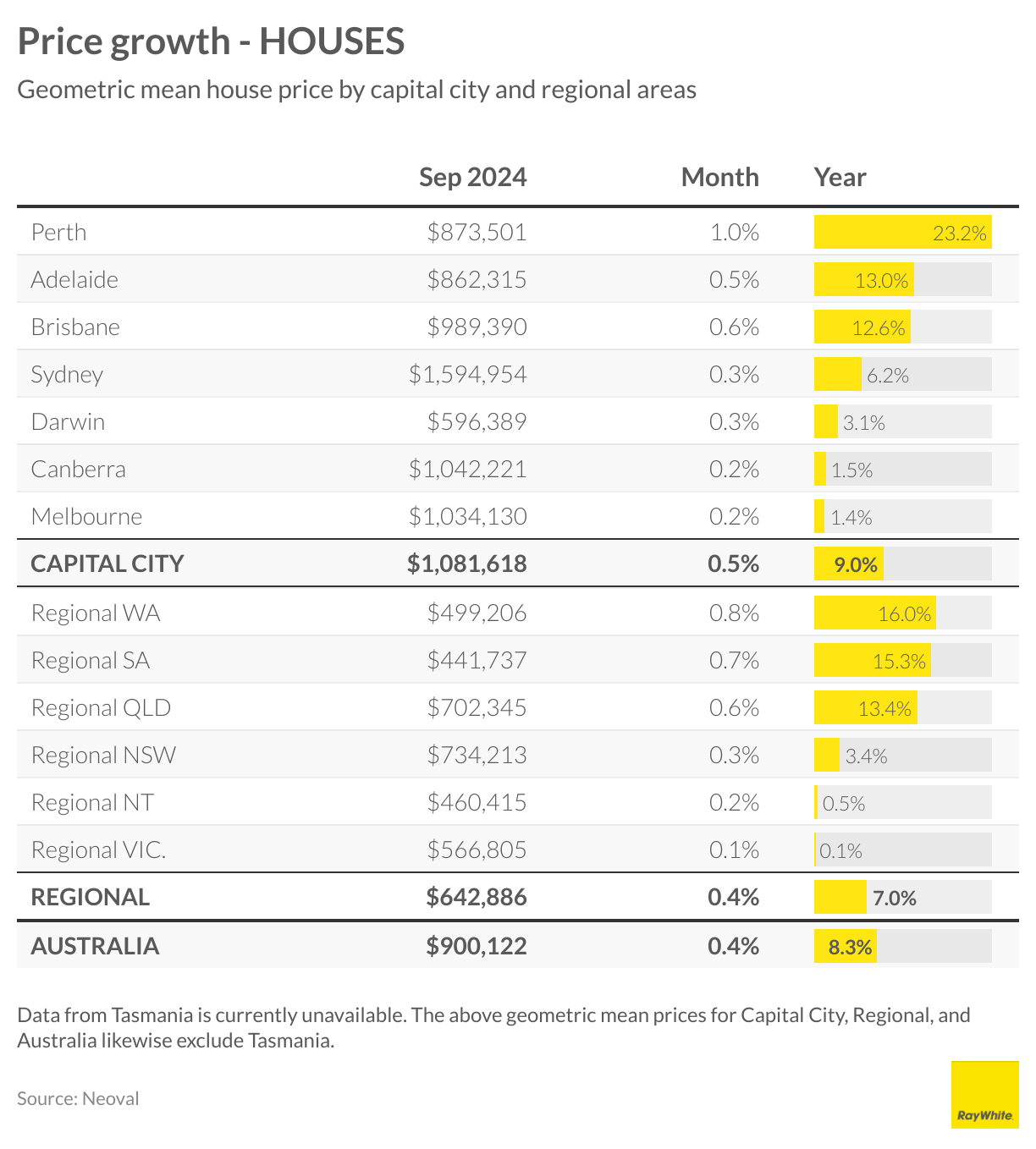

Fast forward to today, and the picture couldn’t be more different. Both Melbourne and regional Victoria now hold the dubious honour of being the slowest property markets in Australia. The vibrancy that once defined Victoria’s real estate sector has dimmed.

At the heart of this downturn lies Victoria’s complex and heavy property tax structure. The state now bears the unenviable title of having the highest property taxes in Australia.

Let’s break down the tax landscape:

Land tax: A progressive tax based on the total value of taxable land owned.

Stamp duty: A significant one-time tax on property purchases.

Council rates: Annual fees for local services.

Capital gains tax: A federal tax on property sale profits (primary residences excluded).

Vacant residential land tax: Targeting unoccupied homes in inner and middle Melbourne.

Absentee owner surcharge: An extra land tax for non-resident owners.

- Foreign purchaser additional duty: An increased stamp duty for foreign buyers.

As if this wasn’t enough, come January 1, 2025, property owners will face yet another financial hurdle: AirBnb levies. While not strictly a property tax, this additional burden is expected to hit hard, especially in regional Victoria where short-term rentals are a significant part of the local economy.

The consequences of this high-tax environment are far-reaching:

Investor exodus: The backbone of the rental market – individual investors – are shying away and limiting the number of rental properties.

Construction slowdown: With investor confidence at an all-time low, new developments, particularly apartment developments, are grinding to a halt.

Foreign investment dries up: The Melbourne CBD’s residential boom was largely fueled by foreign buyers. These investors, crucial in creating affordable rental accommodation for students, have now all but disappeared, deterred by higher taxes.

Commercial sector suffers: It’s not just residential property feeling the pinch. Investors are shying away from Victoria with taxes, particularly those targeting foreign buyers, being a major deterrent.

The property market’s health is often a barometer for the broader economy. With Victoria’s real estate sector in the doldrums, there are legitimate concerns about the knock-on effects on employment, economic growth, and housing affordability.

As the state grapples with these challenges, the question on everyone’s mind is whether Victoria can reclaim its position as Australia’s property powerhouse. The answer may lie in finding a delicate balance between necessary taxation and creating an environment that encourages investment and growth.

One thing is clear: without a significant shift in policy or market conditions, Victoria’s property market may continue to lag behind its interstate counterparts, potentially reshaping the state’s economic landscape for years to come.

Download charts and image of Ms Conisbee here