Australian property buyers ignore climate risks as high-risk suburbs match national growth rates. Insurance costs and extreme weather may soon change the game.

The Australian Government released its first National Climate Risk Assessment this week, a comprehensive analysis of how climate change will impact the country across multiple scenarios. The assessment examines potential impacts at 1.5, 2 and 3 degrees of warming, projecting property value losses of up to $611 billion by 2050 and noting that climate risks will affect all Australian communities. It also warns of dramatic increases in heat-related deaths and coastal flooding, with more than 1.5 million people expected to face sea level rise impacts by mid-century.

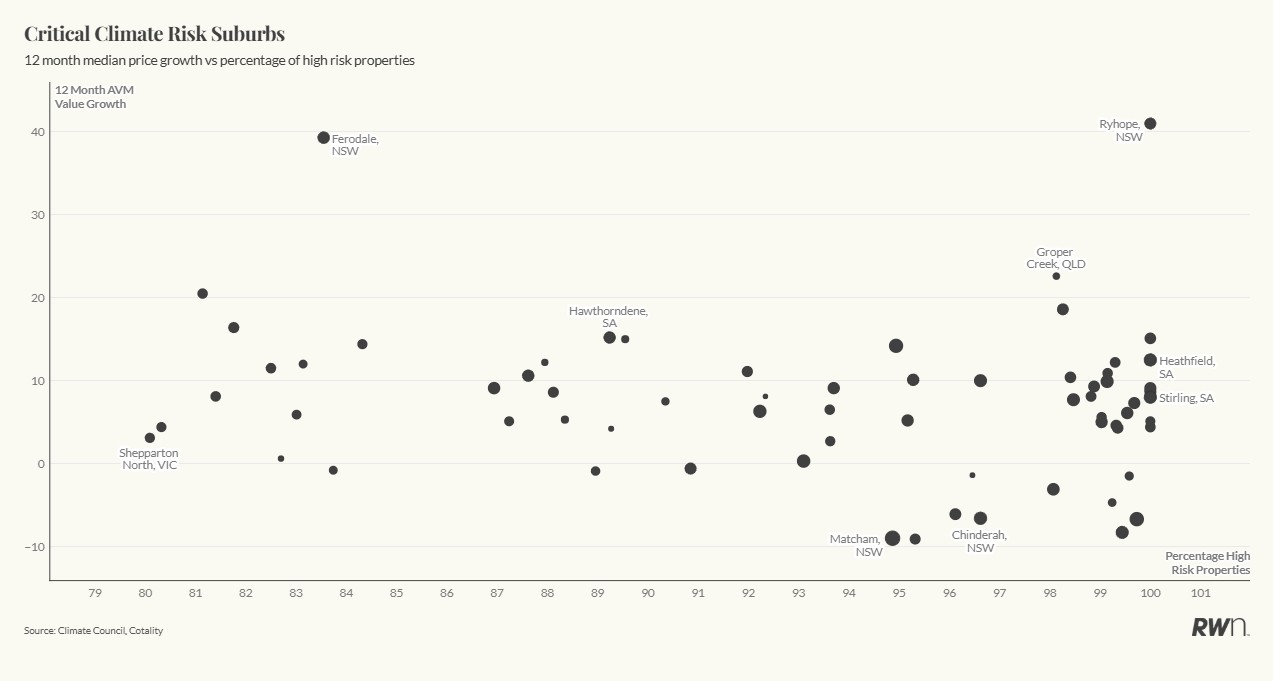

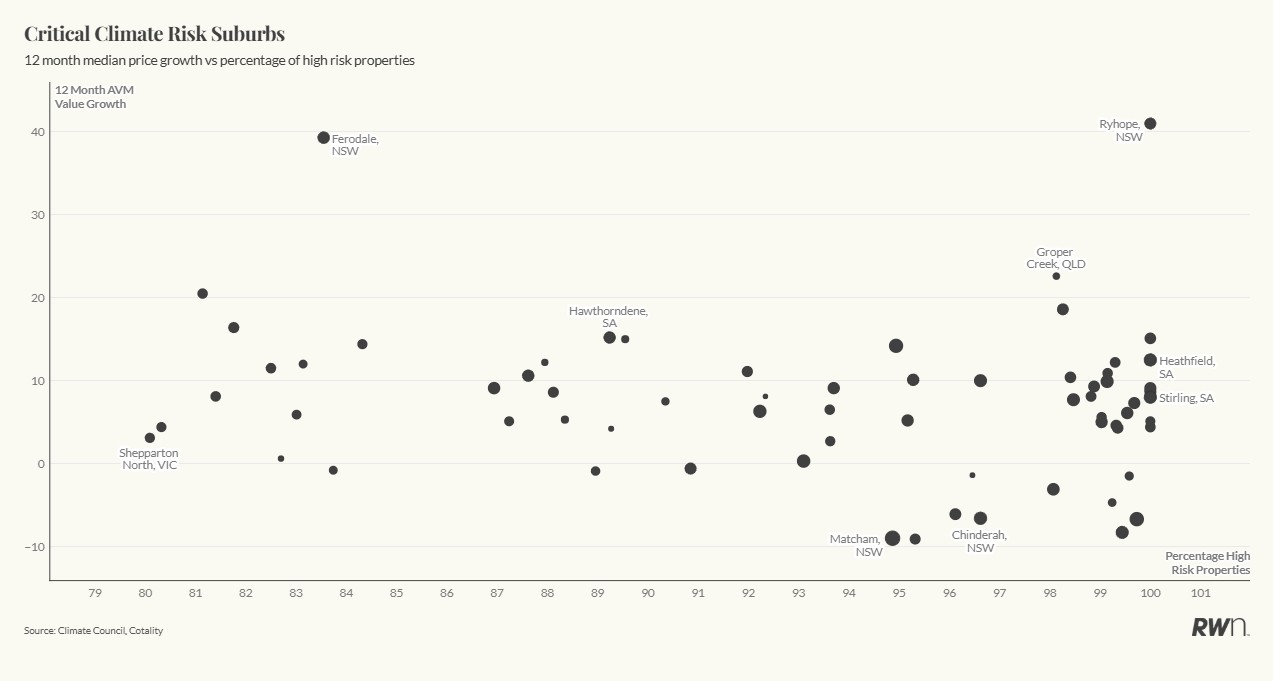

The national report makes clear the scale of the challenge. Yet when we look at how property buyers are currently behaving, climate risk does not appear to be a major factor in decision-making. To test this, we analysed recent price performance in 85 suburbs identified by the Climate Council in their 2024 report At Our Front Door. This research highlighted suburbs and electorates where significant numbers of properties are already at “high risk” from flooding, bushfire, extreme storms and coastal impacts.

The suburbs selected for our analysis represent areas where between 80 and 100 per cent of properties face high climate risk exposure. We examined median house values and 12-month price growth. Property values ranged from under $100,000 in some rural areas to over $2 million in premium lifestyle locations. Of the 85 suburbs identified, 64 had sufficient data available for price growth analysis, covering all states and territories.

Of these 64 suburbs, 58 per cent recorded positive price growth over the past 12 months, with an average rise of 5.8 per cent. This compares closely with national house price growth over the same period, indicating that high-risk suburbs are, at least for now, performing in line with the broader market rather than lagging it. In other words, buyers are not yet pricing in climate vulnerability in a way that is materially affecting values.

The strongest pattern emerges in premium lifestyle locations, particularly South Australia’s Adelaide Hills. Scenic bushland suburbs such as Stirling, Heathfield and Crafers West, where virtually all properties are at high climate risk, still achieved growth rates between 8 and 12.5 per cent with median values around $1.3 – 1.4 million. Similarly, high-value coastal and bushland areas in other states show mixed but often positive results, with some premium locations maintaining strong buyer interest despite extreme risk exposure.

While the majority saw growth, 42 per cent of suburbs experienced price declines. These included both lower-value coastal communities and high-value locations with medians above $1 million. Several New South Wales coastal and bushfire-prone suburbs recorded falls, suggesting parts of the prestige market may be beginning to weigh long-term climate viability.

Regional and rural markets show the most variable performance, with outcomes likely influenced by broader local economic drivers as much as climate risk. Proximity to major cities, lifestyle amenity and established market positioning currently appear to be stronger factors shaping demand than climate vulnerability assessments.

From an investor and buyer perspective, however, risks are beginning to accumulate. Insurance premiums in bushfire and flood-prone areas are already rising, eroding rental yields and household budgets. Some insurers are withdrawing cover altogether, effectively lowering the long-term liquidity of these assets. For owners, this raises the risk of holding stranded property – homes that may be difficult to insure, finance or resell. In addition, escalating premiums and out-of-pocket repair costs could eventually outweigh the lifestyle appeal that has so far driven demand.

Looking ahead, several triggers could accelerate a shift in buyer sentiment. More frequent extreme weather events will directly undermine liveability and safety. Stricter building codes and planning rules may increase costs in high-risk areas, while banks could tighten lending criteria for vulnerable properties. Together, these forces have the potential to create downward pressure on prices in locations that are today still commanding premiums.

For now, lifestyle continues to trump risk. But as financial pressures mount and climate impacts intensify, exposure to extreme weather may become the defining factor in Australian property markets.