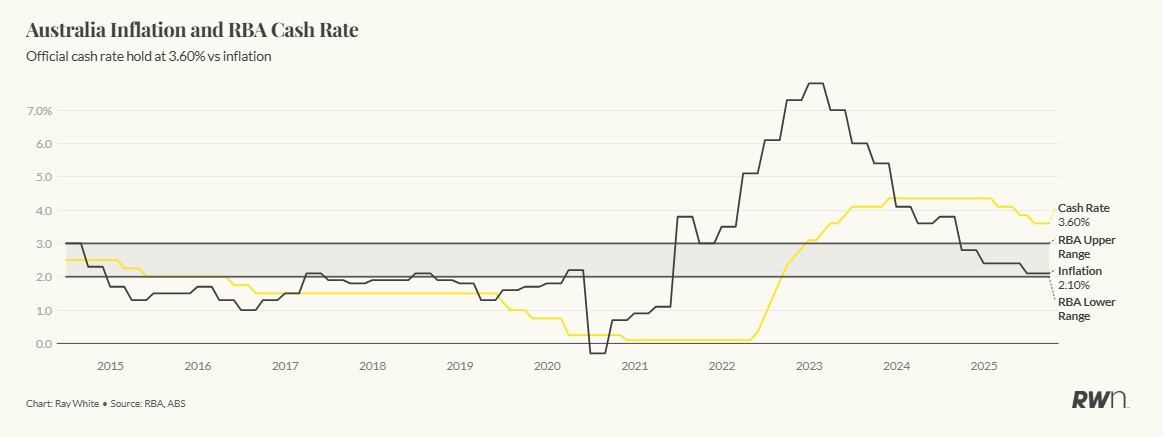

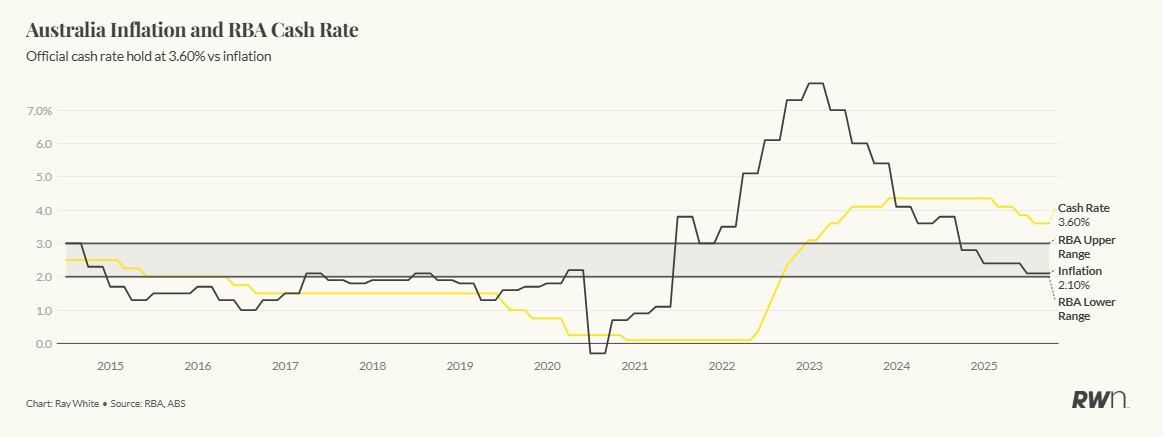

RBA holds rates at 3.60% as inflation resurges to 3.2% annually. Labour market weakens with unemployment rising to 4.5%, leaving the central bank walking a narrow line between price pressures and economic growth.

The Reserve Bank of Australia has held the cash rate steady at 3.60 per cent, opting for caution in the face of a surprisingly strong inflation surge and a labour market that is clearly losing momentum.

Last week’s inflation data delivered an unambiguously hot read. The Consumer Price Index rose 1.3 per cent in the September quarter and 3.2 per cent annually, the fastest quarterly pace since March 2023. The trimmed-mean inflation rate lifted to 3.0 per cent, its first increase since 2022, confirming that underlying price pressures remain broad-based.

Much of the surge reflected the expiry of temporary energy rebates, with electricity prices up 9 per cent in the quarter and 23.6 per cent over the year. But inflation was not confined to utilities – housing, recreation and transport all posted strong gains, suggesting that price momentum has become more entrenched. This has shaken confidence that inflation will drift lower on its own, and it leaves the RBA wary of providing further stimulus.

Bond markets were quick to respond, abandoning expectations of any near-term rate cuts. While investors now see the next move as a cut no earlier than mid-2026, the central bank’s near-term challenge is balancing this renewed inflation pressure with a cooling labour market. And as we have seen clearly, a surprise data announcement can quickly change the direction of rates.

The unemployment rate rose to 4.5 per cent in September, a clear sign that the post-pandemic tightness in labour demand has eased. Job creation has slowed, participation has edged down, and forward indicators such as vacancies point to further softening. Yet unemployment remains within the RBA’s estimates of full employment, giving the Bank little urgency to ease policy in the near term.

Today’s hold reflects a central bank walking a narrow line: inflation has re-accelerated just as growth and employment are fading. The policy stance remains restrictive, and the RBA will want to avoid locking in inflation expectations while also ensuring it does not unnecessarily stall the economy.

Importantly, the ABS’s transition to full monthly CPI reporting begins this month, providing policymakers with more timely data ahead of the final 2025 meeting on 9 December. This improved visibility on prices will give the RBA a firmer footing to assess whether the September inflation spike was a one-off or the start of a renewed trend.

For households, today’s decision means no relief yet on mortgage repayments, and the persistence of price pressures will keep cost-of-living conditions challenging. House price growth however continues, driven by generous first home buyer incentives, three rate cuts this year and a shortage of homes.