National house prices rose 0.6 per cent and units 0.5 per cent over the month, a marked slowdown from August’s “sugar hit” surge of 1.3 per cent and 1.0 per cent respectively.

Australia’s housing market cooled to a more sustainable pace in September following August’s rapid acceleration.

National house prices rose 0.6 per cent and units 0.5 per cent over the month, a marked slowdown from August’s “sugar hit” surge of 1.3 per cent and 1.0 per cent respectively.

The recalibration suggests that the August rate cut provided a one-off boost rather than setting the market on an unsustainably steep trajectory. Buyers responded quickly to cheaper borrowing costs in August, but September’s steadier result points to underlying momentum rather than overheating.

Double-digit growth by year’s end?

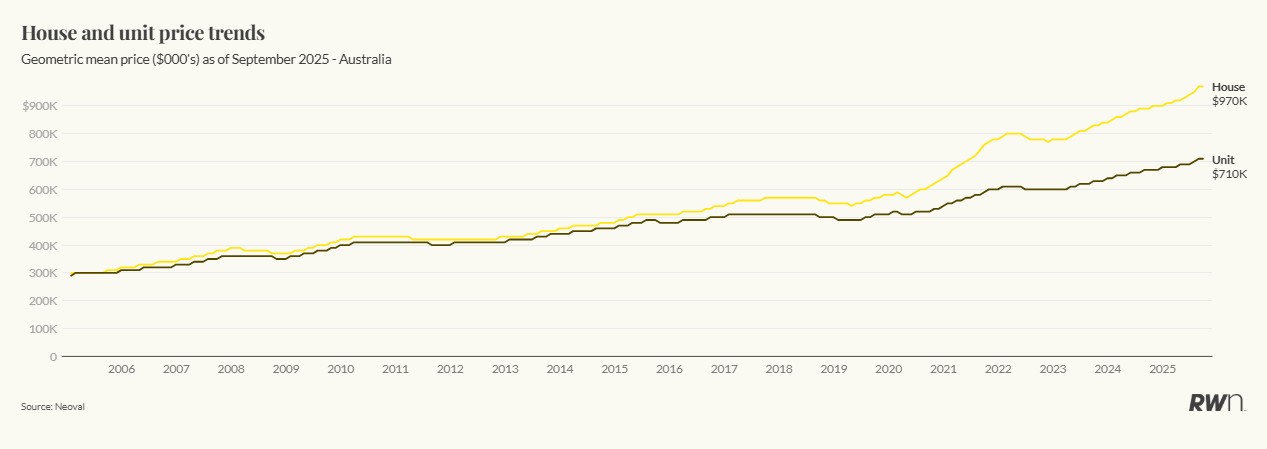

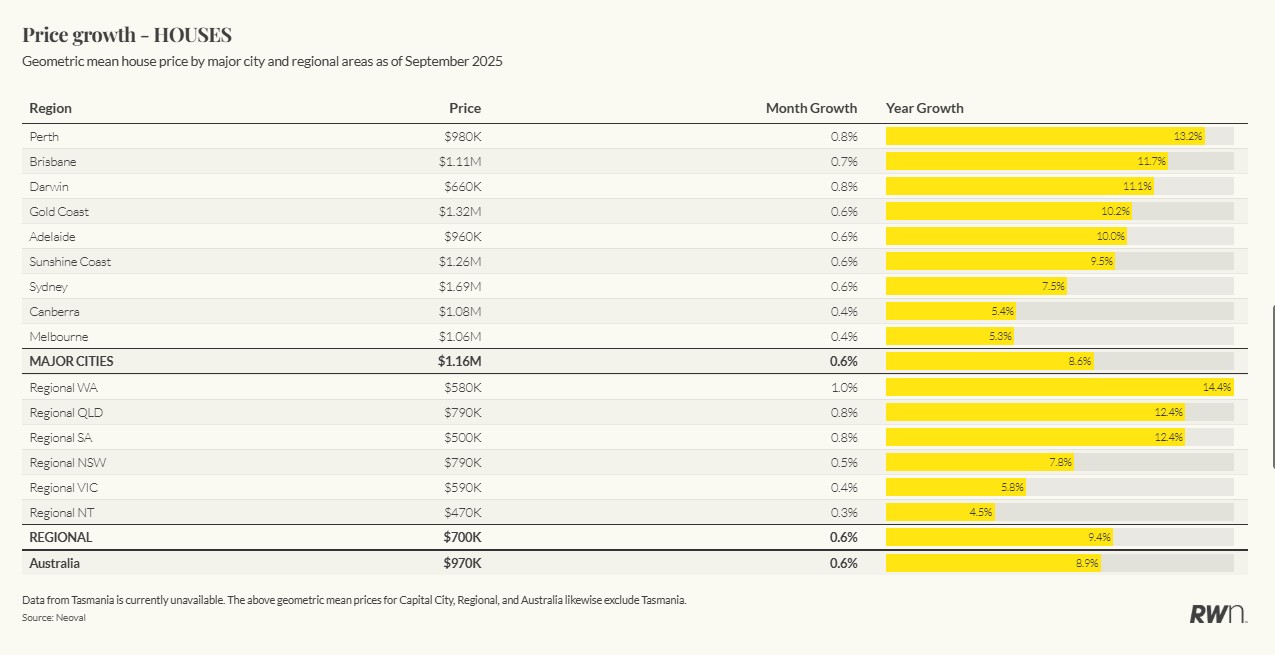

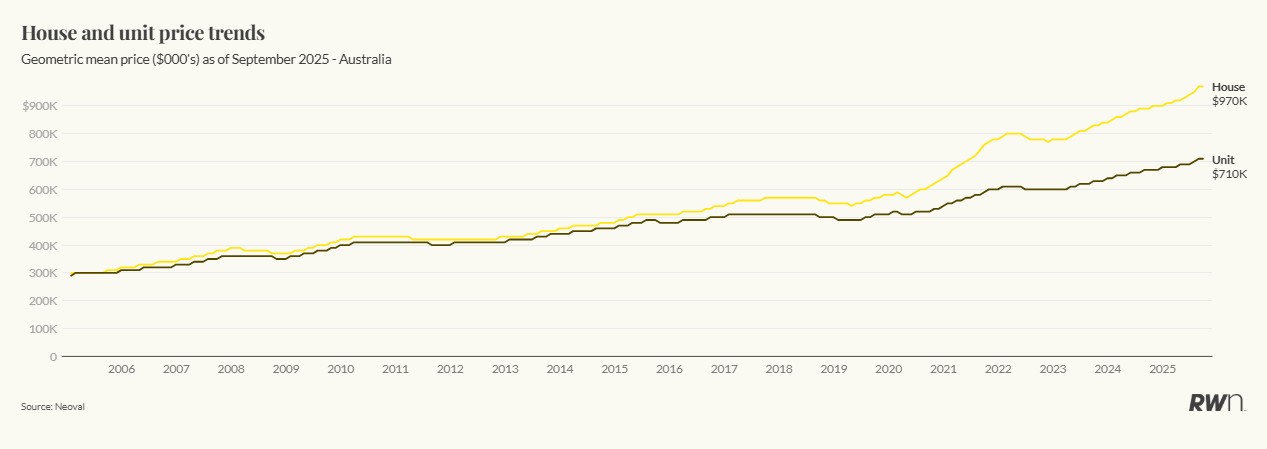

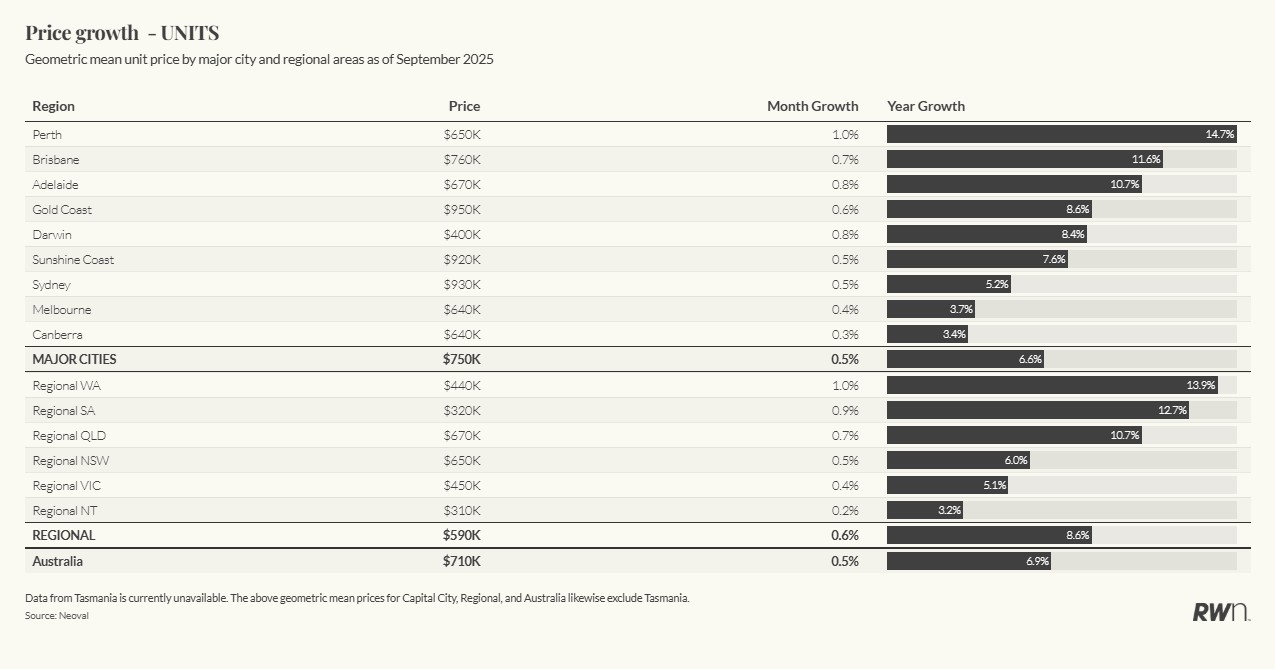

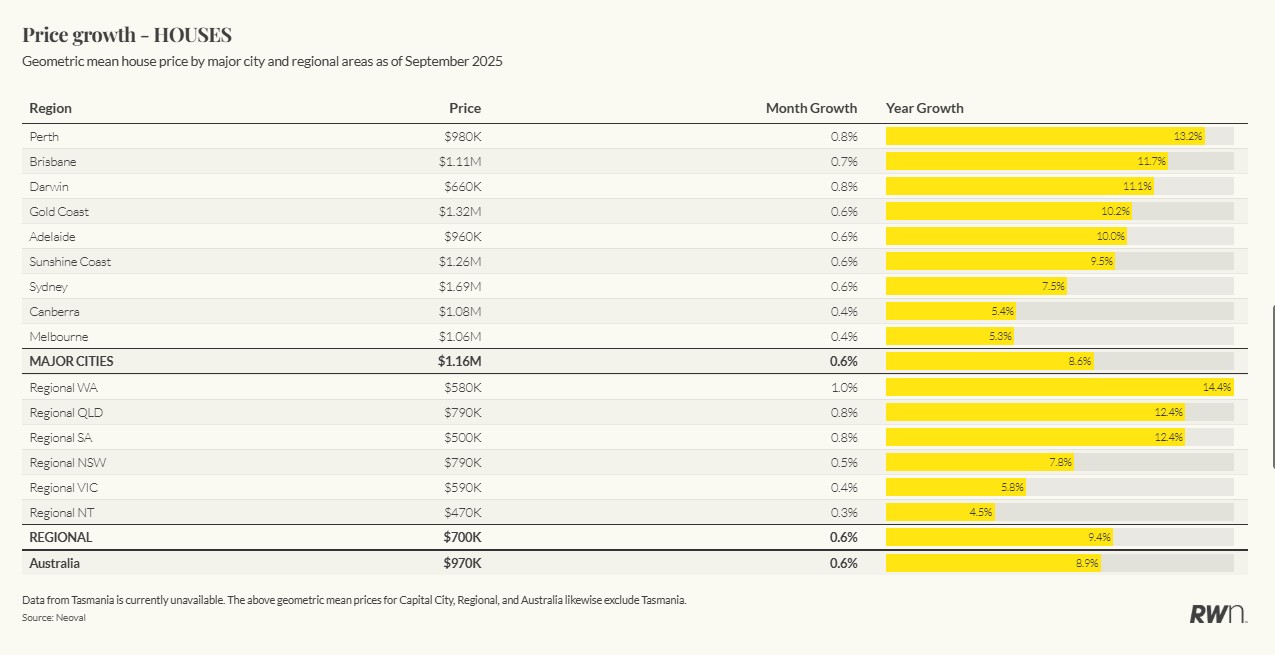

Despite the slower monthly pace, national house prices are still up 8.9 per cent over the year to $970,000, with units up 6.9 per cent to $710,000. If steady growth continues through the final quarter, annual house price growth looks poised to cross into double-digit territory by December.

This outlook will hinge heavily on the Reserve Bank. Markets expect a rate hold tomorrow, and while the chances of a November cut are looking less likely, they remain on the table. Any further easing would provide another burst of demand, potentially accelerating the climb towards double-digit growth.

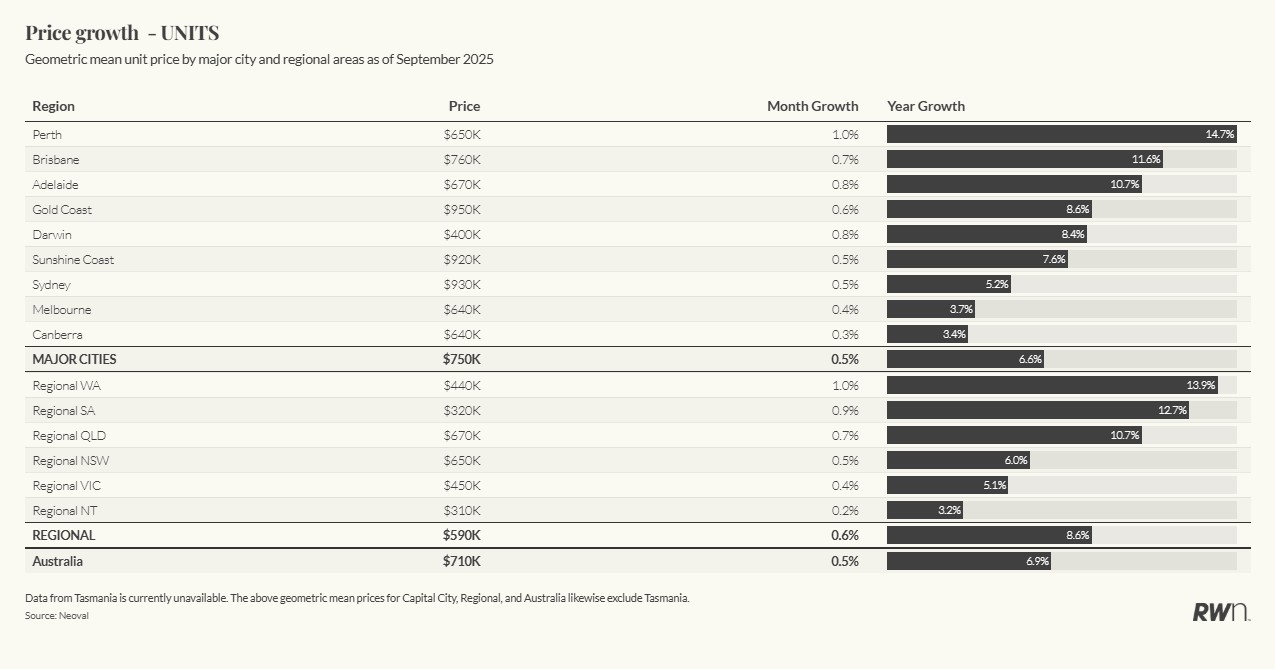

While Perth and regional WA continue to lead the country, the September story is less about local standouts and more about a broad-based lift across the market. Most capitals and regions posted modest monthly increases, enough to keep annual growth strong even as the pace steadies.

Brisbane and Adelaide continue to run ahead of the national average, with annual house price growth of 10.5 per cent and 9.1 per cent respectively, underscoring their growing importance as key drivers of the national cycle. Sydney is moving at a slower 6.3 per cent, but still contributing to overall momentum.

Melbourne, while below the national average at 5.3 per cent, has delivered its strongest annual growth since 2017, a clear sign that the city’s long period of weakness may finally be turning a corner.

While houses continue to lead overall gains, units are not far behind. National house prices are up 8.9 per cent annually compared to 6.9 per cent for units, showing that affordability pressures are still keeping demand for apartments strong, even as detached houses remain the market’s main growth driver.

If national growth holds at current levels, the market is on track to post its first double-digit annual rise since the pandemic boom, underlining the resilience of housing demand even in a higher-rate environment.