Australia’s housing boom since January 2025 suggests Perth/Adelaide hitting $1M medians, Sydney reaching $2M houses and $1M units by the end of 2026. With only Hobart/Darwin to stay under $1M.

Australia’s housing market acceleration, which began in January 2025 after just two months of price declines, has exceeded all expectations and is now pointing toward a dramatic reshaping of the national property landscape by the end of 2026. Current trajectories suggest Perth and Adelaide house medians will breach the million-dollar threshold, while Sydney appears destined for a two-million-dollar median and one-million-dollar units. Only Hobart and Darwin will retain house medians below one million dollars.

The momentum that began with January’s recovery has intensified significantly following the Reserve Bank’s second interest rate cut in April, with two additional cuts anticipated before year’s end. What started as expectations of modest growth has evolved into conditions similar to 2021, far exceeding early-year predictions.

Growth momentum exceeds all early year expectations

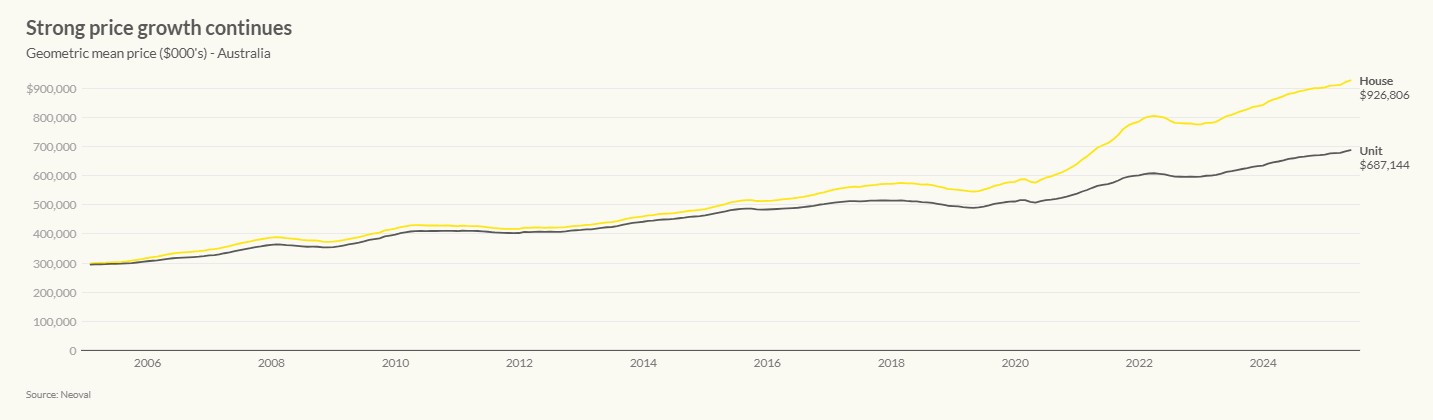

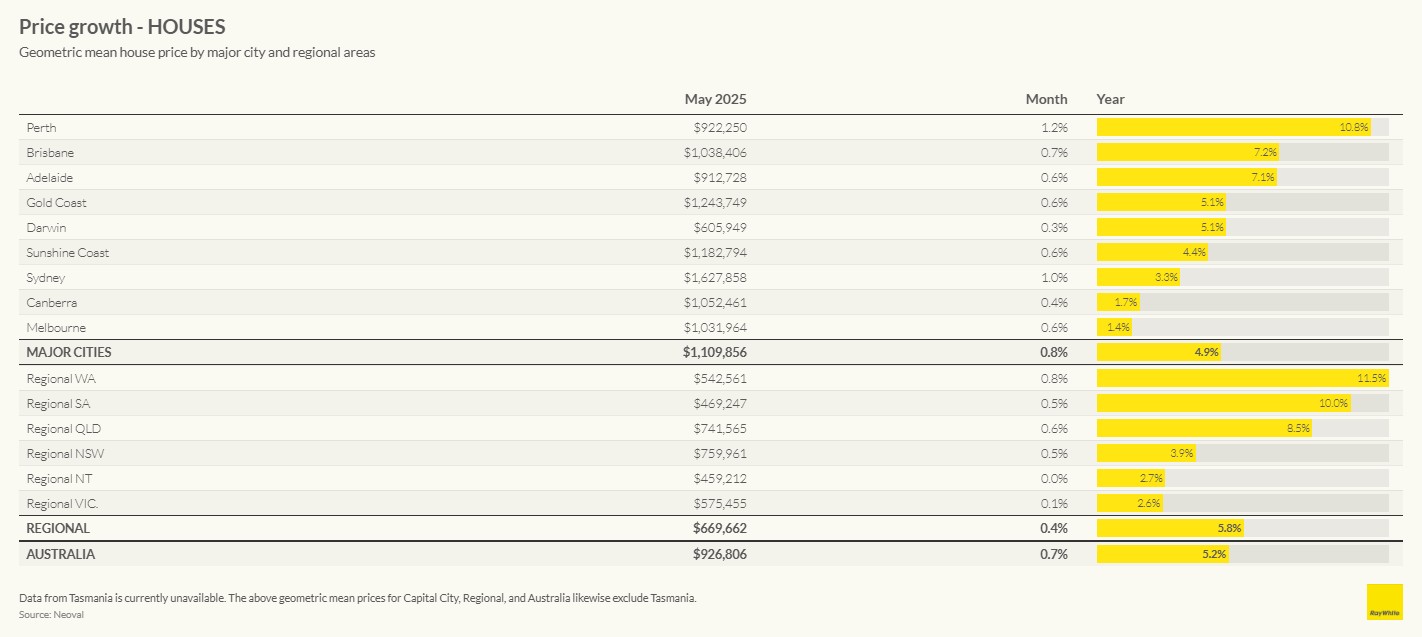

May’s data confirms the housing market’s relentless acceleration that began in January has far exceeded initial expectations, with national house prices rising 0.7 per cent to reach $926,806, delivering annual growth of 5.2 per cent. What began as a modest recovery from December’s brief decline has evolved into sustained momentum that few predicted at the start of 2025.

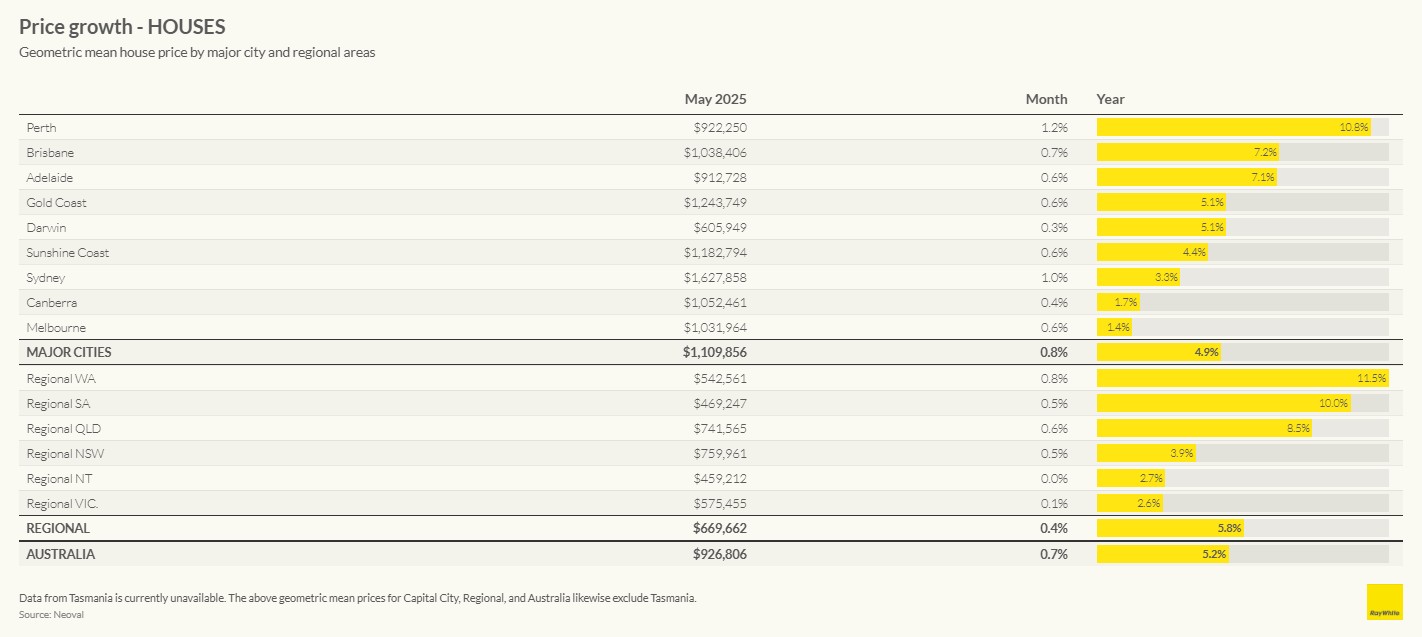

Perth continues its extraordinary trajectory with house prices advancing 1.2 per cent in May, propelling annual growth to 10.8 per cent. At $922,250, Perth houses are within striking distance of the million-dollar threshold. Adelaide maintains robust momentum with annual growth of 7.1 per cent, reaching $912,728.

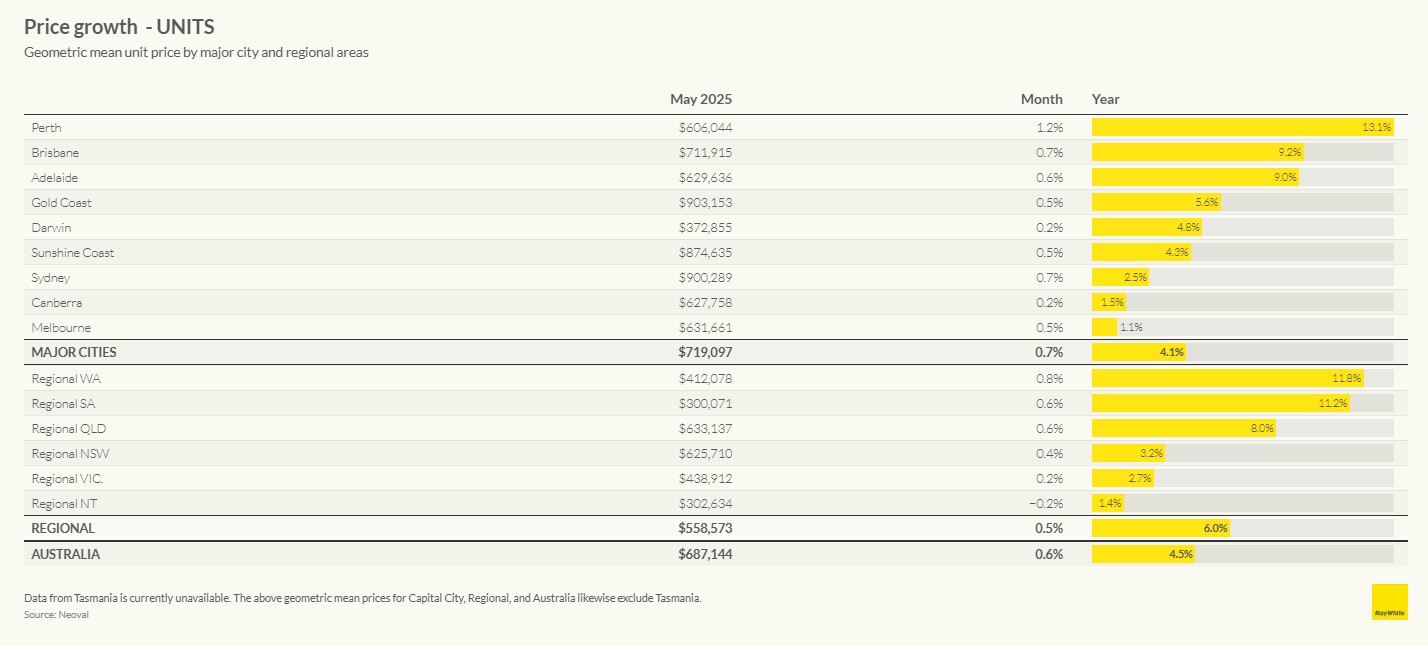

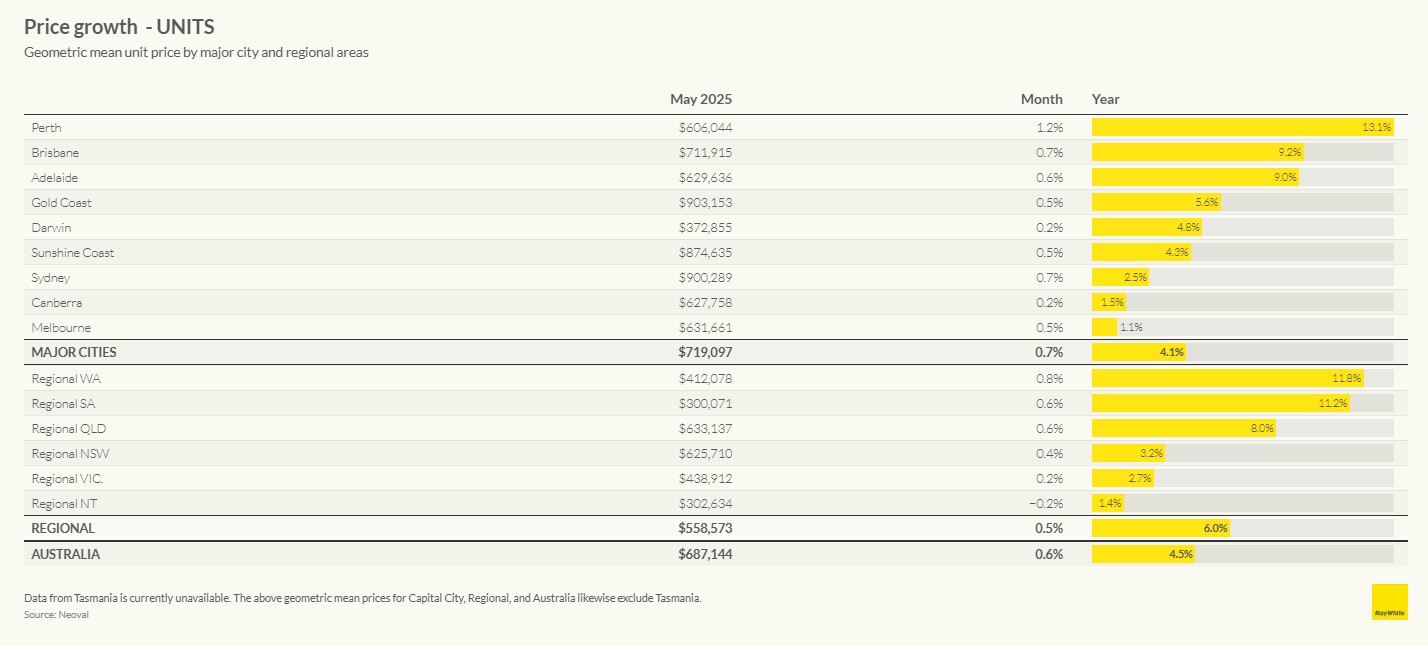

Sydney’s trajectory positions the harbour city for a two-million-dollar median by late 2026, while the unit market at $900,289 appears destined to join the million-dollar club.

If current growth rates continue, Perth requires just eight months to reach a one-million-dollar median. Adelaide will achieve this milestone within approximately fifteen months. Sydney’s acceleration toward two million dollars continues with it now sitting at $1.6 million. Given Sydney’s sensitivity to rate cuts, and the potential for more cuts coming through this year, hitting a $2 million dollar median seems possible by the end of next year.

Regional markets are outpacing capitals, with Regional Western Australia posting 11.5 per cent annual growth and Regional South Australia achieving 10.0 per cent, demonstrating the breadth of current price pressures.

Persistent construction challenges continue limiting new housing supply, providing fundamental support for existing property values. The construction industry’s ongoing struggles with labour shortages and material costs create supply bottlenecks that cannot be resolved quickly. In addition land prices aren’t coming down and will in fact be supported by lower rates.

What could derail the momentum

While current conditions appear supportive of continued price growth, several factors could disrupt this trajectory. Rising unemployment resulting from slowing global economic growth triggered by trade tensions could weaken buyer demand, despite interest rate cuts providing some offset. Perversely, the current surge in prices may kickstart more development projects as margins become attractive enough to overcome construction challenges, ultimately increasing supply. However, given the time required for new projects to reach market, any supply response would likely take years to meaningfully impact prices.