First home buyers priced out of premium suburbs can access dream postcodes by choosing apartments over houses, saving up to $2M in desirable locations with units under $750k.

First home buyers priced out of premium suburbs by million-dollar house prices have a pathway to their dream postcodes. Analysis of suburbs offering the biggest price gaps between houses and apartments reveals opportunities for first-time purchasers to save up to $2 million by choosing units over houses in Australia’s most desirable locations.This analysis focuses specifically on areas delivering the greatest house-apartment price differentials with apartments in the chosen suburbs having a median under $750,000, generally considered within first home buyer budgets.

If you buy an apartment in these suburbs, you aren’t getting compromised locations or second-tier suburbs. The top-ranking areas include some of Australia’s most prestigious addresses: riverside Perth enclaves, Melbourne’s inner-city havens, and Canberra’s parliamentary triangle neighbourhoods where apartments provide genuine access to million-dollar lifestyles at first home buyer prices.

The national top ten: where the biggest savings await

Australia’s premier first home buyer opportunities concentrate heavily around Melbourne’s inner suburbs, with six of the top ten national positions delivering apartment access to areas where houses exceed $2 million. Leading the national rankings, Perth’s exclusive Mosman Park-Peppermint Grove offers apartments at $552,000 while houses command $2.51 million – a staggering $1.96 million saving for first-time purchasers.

Melbourne’s Hawthorn South claims second position nationally, with $560,000 apartments providing access to one of the city’s most prestigious inner suburbs where houses average $2.48 million. The savings of $1.92 million demonstrates the extraordinary value proposition for first home buyers prepared to embrace apartment living.

Others in the top 10 include Armadale ($735,000 apartments, $1.9 million savings), Malvern-Glen Iris ($718,000 apartments, $1.9 million savings), and Hawthorn North ($655,000 apartments, $1.8 million savings). Each location offers world-class schools, excellent transport links, and the kind of lifestyle amenities that typically require multi-million-dollar budgets.

Canberra claims two positions in the national top ten, with Griffith apartments at $685,000 and Reid units at $617,000 both delivering savings exceeding $1.6 million. For public servants and professionals building careers in the national capital, these suburbs provide prestige addresses within walking distance of Parliament House and major government departments.

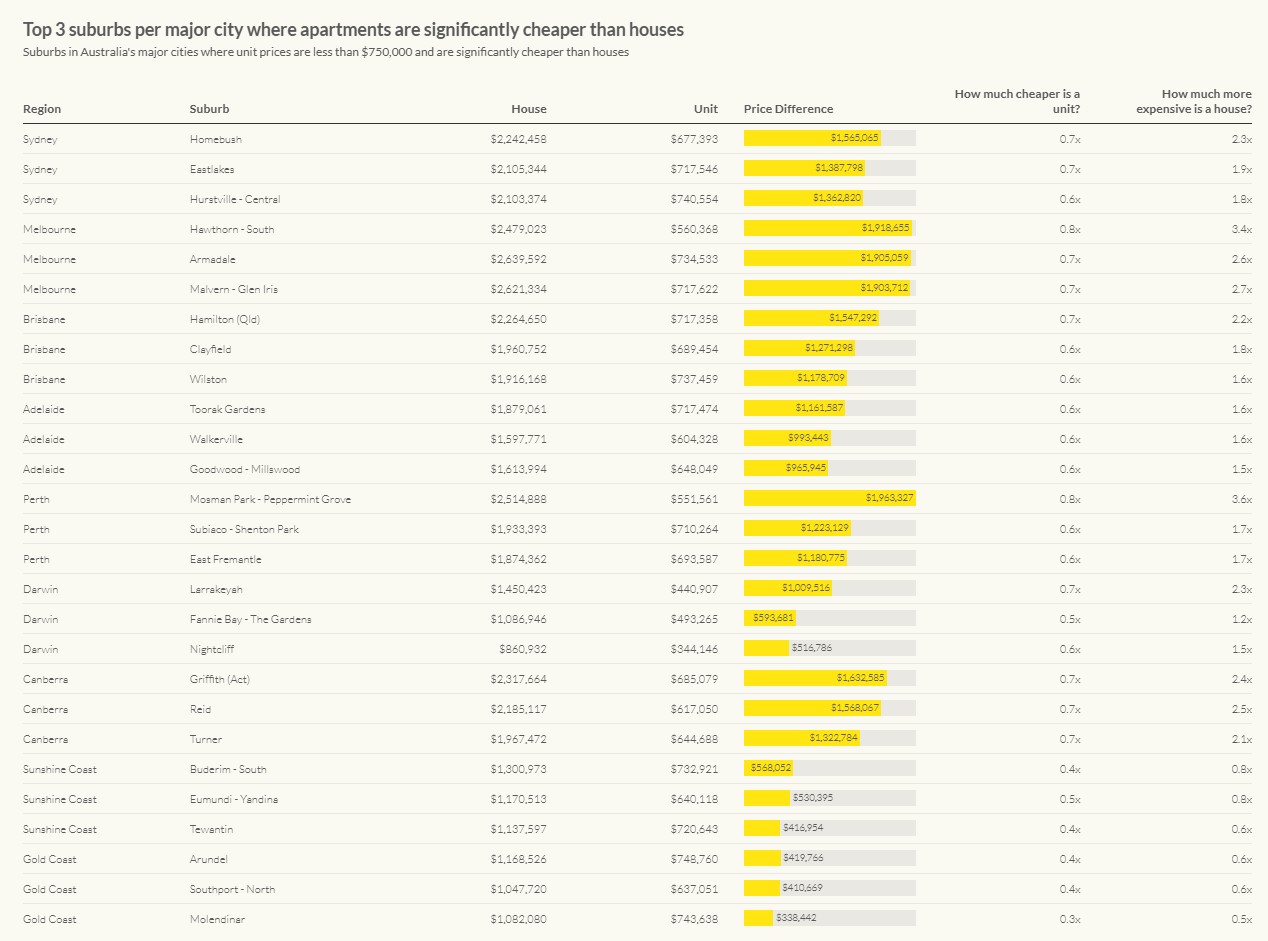

The top three opportunities in each major centre

Every Australian capital city offers first home buyers access to premium suburbs through apartment living, with savings ranging from $500,000 in Darwin to nearly $2 million in Perth.

Sydney’s accessible premium sees Homebush leading the city’s opportunities at $677,000 for apartments, delivering $1.6 million in savings over houses. Despite Sydney’s reputation for impossible first home buyer conditions, Eastlakes ($718,000) and Hurstville Central ($741,000) provide genuine pathways to quality addresses with excellent transport links and established amenities.

Melbourne’s inner sanctum dominates national rankings with Hawthorn South ($560,000), Armadale ($735,000), and Malvern-Glen Iris ($718,000) all delivering savings approaching $2 million. These suburbs provide access to Melbourne’s cultural heart, prestigious school zones, and neighbourhoods that have delivered consistent capital growth over decades, making them ideal long-term wealth-building locations for first-time purchasers.

Brisbane’s riverside elite offers Hamilton apartments at $717,000, Clayfield units at $689,000, and Wilston properties at $737,000 – all providing access to some of Queensland’s most desirable addresses with savings between $1.2-$1.5 million. These riverside locations offer lifestyle amenities typically associated with multi-million-dollar budgets.

Adelaide’s eastern elegance leads with Toorak Gardens apartments at $717,000, followed by Walkerville at $604,000 and Goodwood-Millswood at $648,000. South Australia’s opportunities provide excellent value for first home buyers targeting the state’s most prestigious addresses, with savings exceeding $1 million in the top-ranked suburb.

Perth’s exclusive western corridor delivers the nation’s best value with Mosman Park-Peppermint Grove apartments at $552,000, followed by Subiaco-Shenton Park at $710,000 and East Fremantle at $694,000.

Darwin’s waterfront premium offers exceptional value with Larrakeyah apartments at just $441,000, Fannie Bay-The Gardens at $493,000, and Nightcliff at $344,000.

Canberra’s parliamentary precinct provides Griffith apartments at $685,000, Reid units at $617,000, and Turner properties at $645,000 – all delivering savings exceeding $1.3 million while providing walking distance access to Australia’s seat of power and major employment centres.

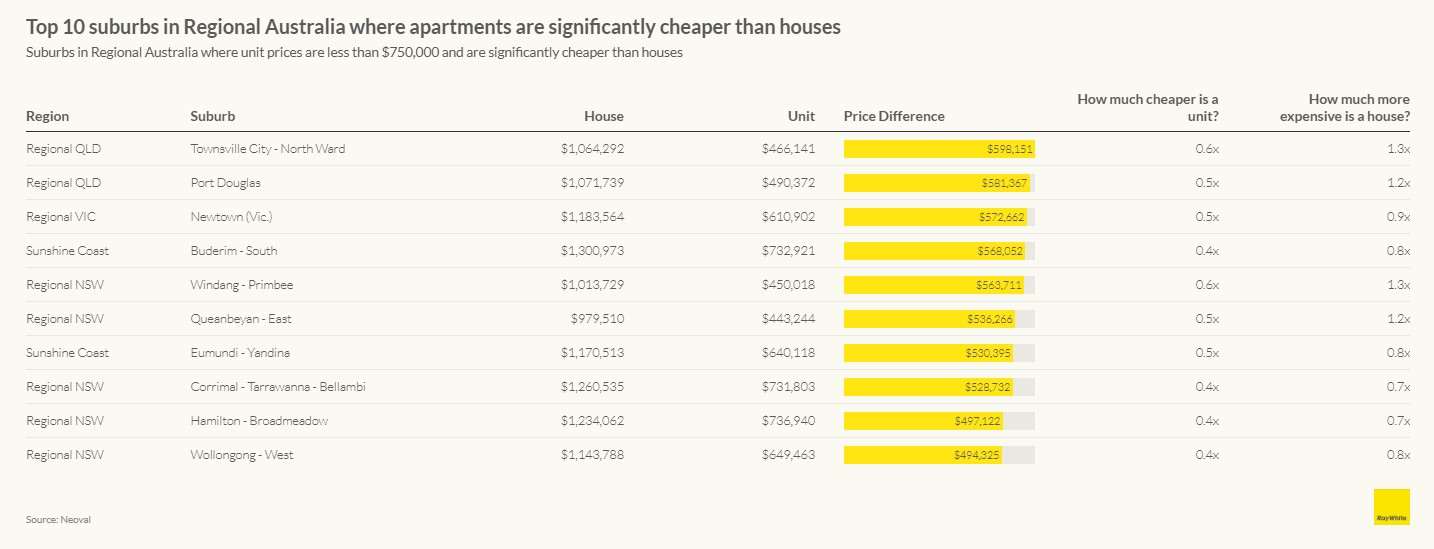

The top ten beyond the capitals

Regional Australia offers first home buyers a different opportunity set, with coastal lifestyle locations and major regional centres providing quality apartment living at prices that deliver substantial savings over house alternatives. While the absolute savings are smaller than capital city opportunities, the lifestyle and affordability benefits remain compelling.

Queensland dominates regional opportunities, claiming six of the top ten positions. Townsville’s North Ward leads at $466,000, followed by Port Douglas at $490,000 – both delivering around $600,000 in savings while providing access to tropical lifestyle benefits typically associated with much higher price points.

The Sunshine Coast’s Buderim South offers apartments at $733,000, while Eumundi-Yandina provides options at $640,000 – both delivering access to one of Australia’s most desirable coastal lifestyle regions. These locations provide the beach proximity and lifestyle amenities that drive house prices well beyond typical first home buyer budgets.

New South Wales contributes several regional opportunities, with Windang-Primbee apartments at $450,000 providing coastal access south of Sydney, while Queanbeyan East at $443,000 offers Canberra proximity at regional prices. The Illawarra region features prominently, with Corrimal-Tarrawanna-Bellambi at $732,000 and Wollongong West at $649,000 providing excellent coastal access within commuting distance of Sydney.

Government first home buyer assistance, including stamp duty concessions and deposit schemes, often apply equally to apartments in expensive suburbs as to houses in cheaper areas. While there is often the view that houses always outperform apartments for house price growth, the reality is that apartments in premium suburbs can often outperform houses in much more affordable locations.

Methodology

This analysis utilised geometric mean property price data by Statistical Area Level 2 (SA2) provided by property data company Neoval. The geometric mean was selected as the primary measure as it provides a more representative central value for property prices by reducing the impact of extreme high or low values that can skew simple averages.

The methodology involved comparing geometric mean prices for houses against geometric mean prices for apartments across all SA2 areas in Australia. To identify the most attractive opportunities for first home buyers, the analysis was filtered to include only SA2 areas where:

The geometric mean apartment price was under $750,000 (considered within typical first home buyer budget parameters)

A measurable price gap existed between houses and apartments in the same SA2 area

The results were then ranked by the absolute dollar difference between house and apartment geometric means, with the largest gaps indicating the greatest potential savings. This approach identified suburbs where first home buyers could access premium locations through apartment purchases while achieving maximum cost savings compared to house purchases in the same areas.

Separate analyses were conducted for capital cities and regional areas to provide targeted insights for different buyer segments and geographic preferences.