Despite rate rises, land prices jumped 75 per cent since 2020 while construction costs finally moderate. For affordable housing, either building costs must fall or land values must drop significantly.

Australia’s housing affordability challenge has an underlying mathematical reality: for new homes to become genuinely affordable, either construction costs must fall or land prices must drop significantly. While construction costs are finally moderating after their pandemic surge, land prices – particularly for development sites – remain stubbornly elevated despite the sharpest interest rate rises in decades. Indeed, median development site prices have risen by more than 75 per cent since 2020, even as rates soared. This unexpected resilience in land values is reshaping how we think about housing market cycles and what it takes to deliver affordable new housing.

Construction costs are moving in the right direction, but not fast enough

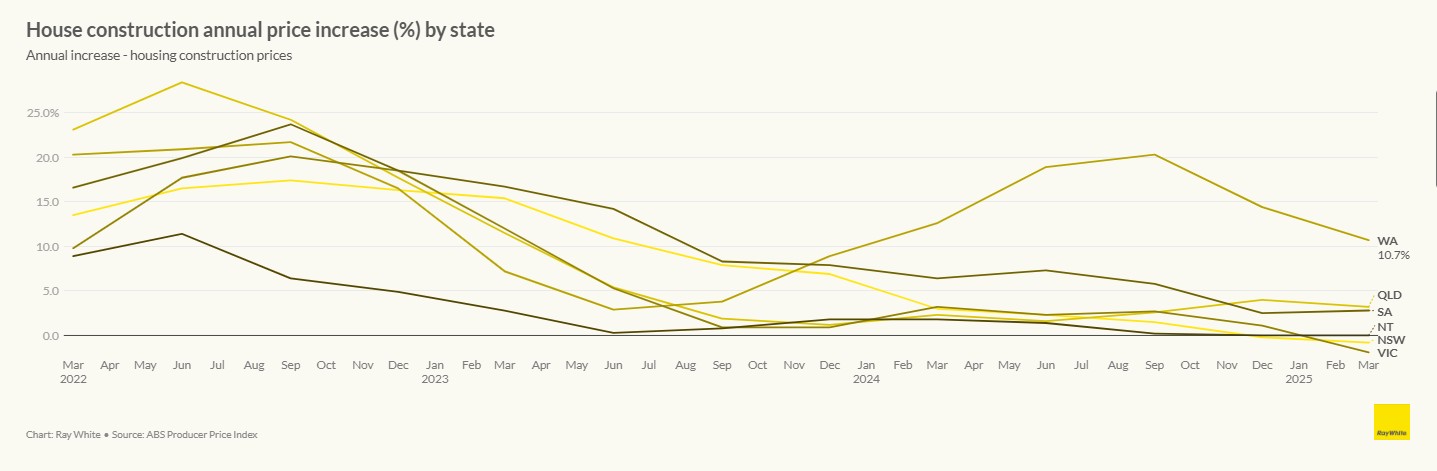

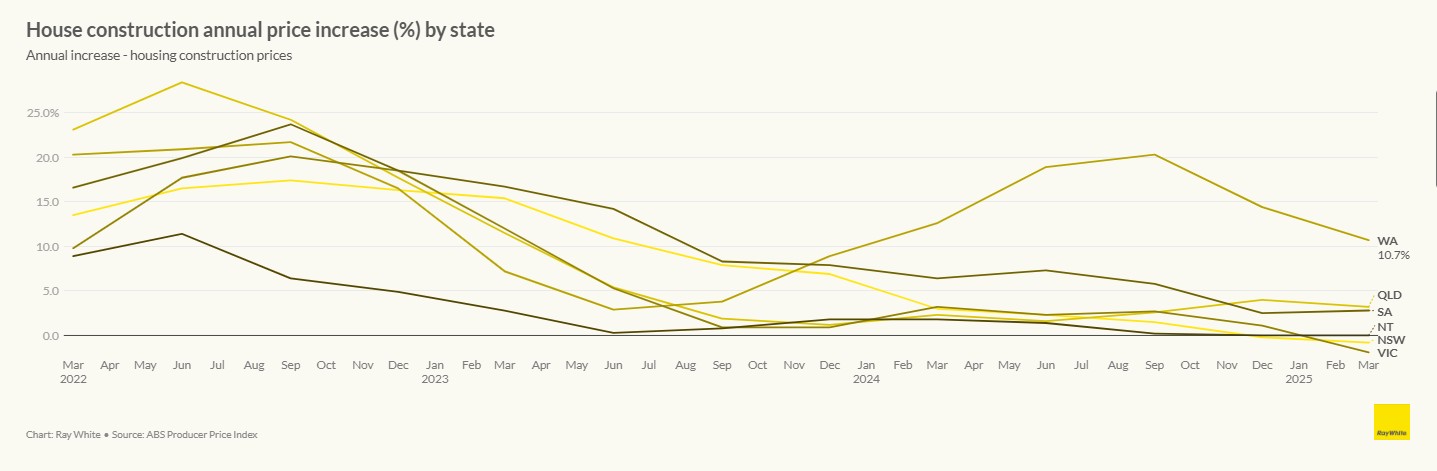

There’s some good news on the construction front. After soaring to extraordinary heights during the pandemic, building costs are finally moderating. At their peak in mid-2022, construction prices were rising by more than 25 per cent annually in some states. Now, most states are seeing annual increases of less than five per cent, with Victoria actually recording slight price declines.

However, “moderating” doesn’t mean “affordable.” Even with these improvements, construction costs remain elevated from their pre-pandemic levels. While the trajectory is promising, it will take considerable time before building costs fall enough to make new housing genuinely affordable for average buyers.

The land price problem: why development sites aren’t getting cheaper

This brings us to the other side of the affordability equation: land prices. In a typical economic downturn, rising interest rates would force property owners into distress, leading to sales that drive down land values. But something different is happening this time around.

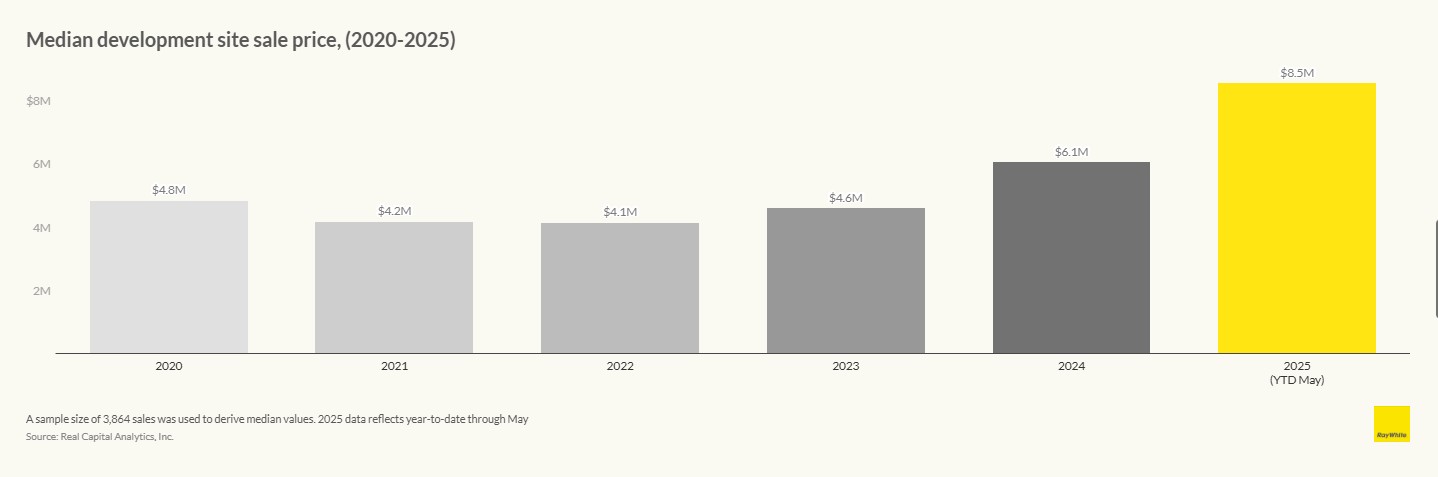

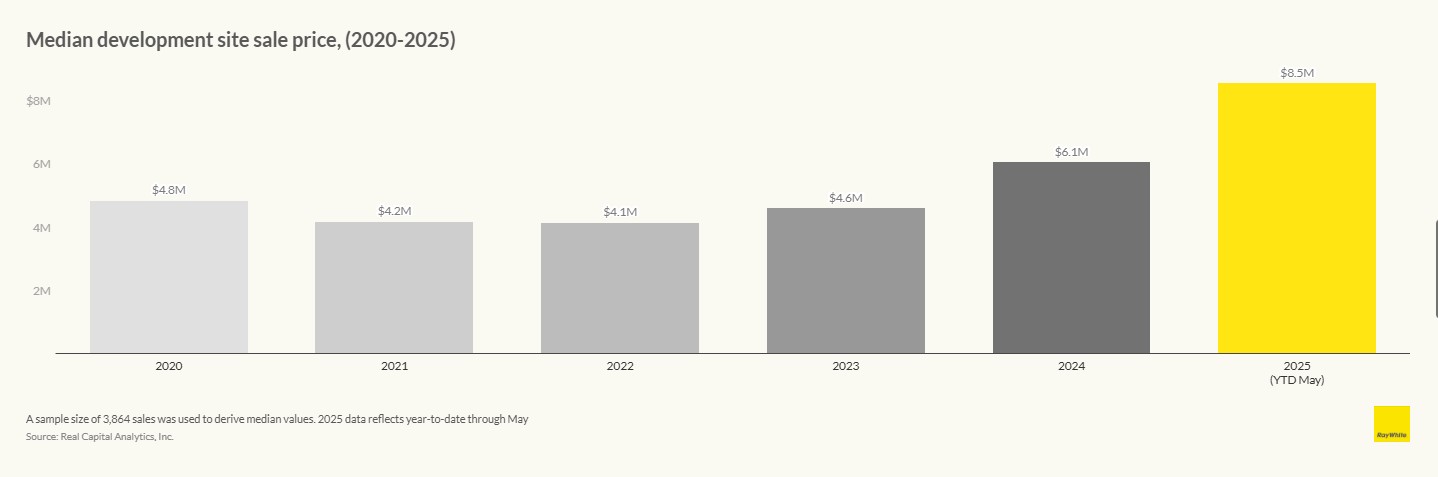

Despite interest rates rising from near-zero to over four per cent in less than two years, owners of development sites aren’t being forced to sell. In fact, the opposite is occurring. An analysis of 3,864 development site sales over the past five years shows that the median development site sale price in Australia has increased from $4.8 million in 2020 to $8.5 million in 2025 – a rise of more than 75 per cent even as interest rates soared.

Land prices, particularly for development sites, have remained stubbornly high. So why aren’t these landowners more challenged?

Why this time is different

Better financial buffers

Today’s development site owners are far better prepared than in previous cycles. During the unprecedented period of ultra-low interest rates from 2011 to 2022, sophisticated investors and developers built up substantial equity buffers. Many locked in long-term, low-cost funding or used hedging strategies to protect against rate rises. This means they can weather the current storm without being forced into distressed sales.

Smarter money management

Rather than rushing to sell in a difficult market, many landowners are adopting alternative strategies. Some are seeking joint venture partners, exploring different development approaches, or simply waiting for conditions to improve. This flexibility comes from having stronger balance sheets and more sophisticated financial planning than previous generations of property developers.

A bigger pool of lenders

Perhaps most importantly, the lending landscape has transformed dramatically. In previous cycles, property development was largely funded by traditional banks with rigid lending criteria. When banks tightened their belts, owners had few alternatives.

Today’s market is completely different. Non-bank lenders have expanded rapidly, institutional investors like superannuation funds are active in property development, and foreign investment provides additional capital sources. These alternative lenders often offer more flexible terms, including mezzanine finance and hybrid arrangements that don’t have the same strict repayment requirements as traditional bank loans.

Lender patience

Even traditional lenders are behaving differently. Rather than forcing quick sales that might damage asset values, banks are more likely to offer covenant relief or workout arrangements. Post-Global Financial Crisis regulations have made lenders more systematic about managing distressed assets, leading to more patient approaches.

What this means for housing affordability

The result of these changes is that the normal economic cycle isn’t working as expected. Typically, higher interest rates would force some property owners to sell, increasing supply and reducing prices. But the current generation of development site owners has the financial resources and flexibility to hold on, keeping land prices elevated.

This creates a challenging situation for housing affordability. With construction costs only moderating slowly and land prices showing little sign of meaningful decline, the two main pathways to cheaper housing remain blocked.

The developer’s dilemma

This situation creates genuine frustration for developers who want to build. Many are sitting on sites they purchased when projects looked viable, but current land values make new developments uneconomical. They’re caught between land prices that won’t fall and construction costs that remain elevated, making it difficult to deliver housing that buyers can afford.

It’s a circular problem: developers can’t start projects because the numbers don’t work, which means less housing supply, which keeps prices high. Meanwhile, landowners who might sell aren’t under enough financial pressure to accept lower prices.

Looking ahead

The structural changes in property development financing represent a positive evolution in many ways. A more stable, well-capitalised property sector with diverse funding sources is generally healthier than one prone to boom-bust cycles that can devastate communities and investors alike.

However, this stability comes with trade-offs for housing affordability. The mechanisms that previously created price corrections during economic downturns, while often painful, also periodically made land more accessible for new development. Without these natural pressure valves, finding pathways to affordable housing may require different approaches than simply waiting for market cycles to run their course.