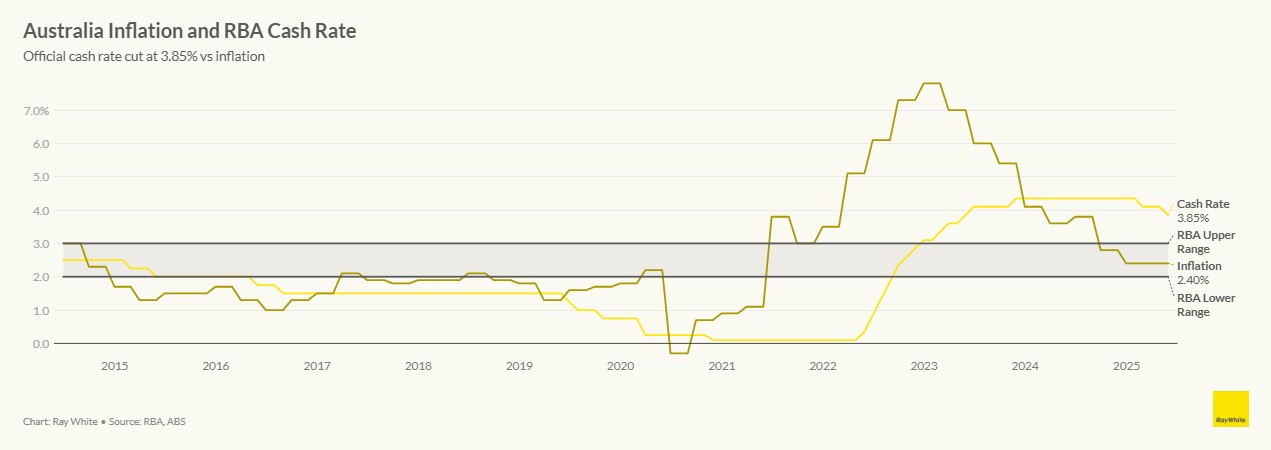

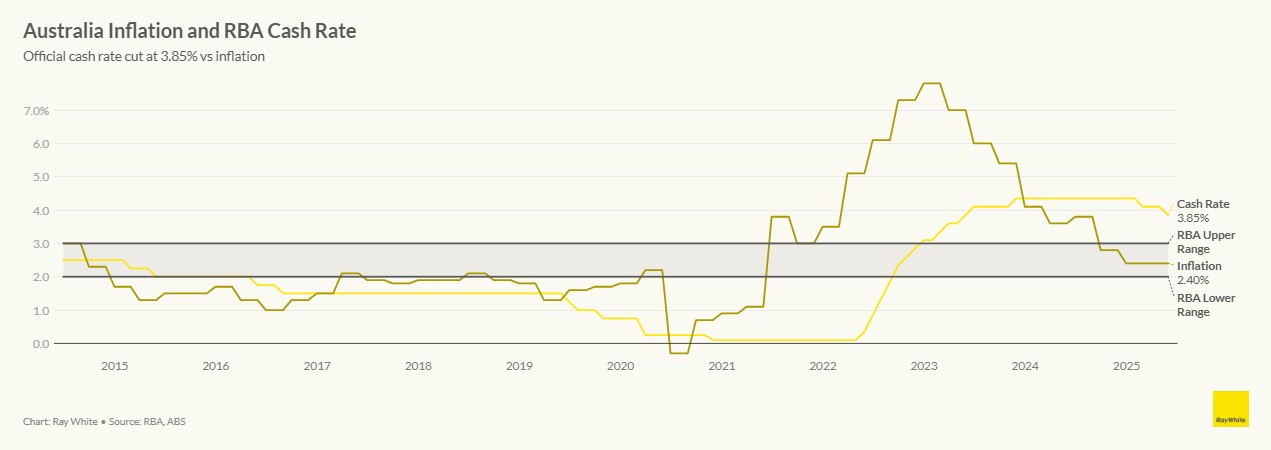

Good news: RBA cuts cash rate by 0.25 per cent. While the cut will be welcomed by many, it has been driven primarily by continued global uncertainty brought about by the election of Trump in the US.

While extremely high tariffs put on US businesses and consumers will primarily impact local residents in that country, the impact on China specifically has the potential to impact Australia’s economic growth.

In addition, while Australia is not a major trading partner with the US, supply chain disruptions and the potential for global pricing by US companies is likely to impact our inflation rate. This could be offset somewhat by lower prices for products out of China however the extent to which this happens is highly uncertain.D

Housing market already showing strong momentum

The cut comes at a time when Australia’s housing market is already demonstrating remarkable resilience. April data confirmed the acceleration of price growth that began in January, with house prices nationally rising by 0.4 per cent to reach a median of $917,433, representing an annual growth of 5.2 per cent.

The unit market showed even stronger monthly momentum with prices increasing by 0.5 per cent to $685,637, delivering a yearly growth rate of 4.6 per cent. This widespread acceleration suggests we’re entering a new phase in the market cycle, with 13 out of 14 regions showing accelerating growth when comparing recent three-month periods.

Unemployment concerns on the horizon

The global economic slowdown triggered by US-China trade tensions raises the spectre of rising unemployment in Australia. As export demand potentially weakens and businesses face supply chain disruptions, job security could deteriorate across several sectors.

However, history suggests the housing market demonstrates surprising resilience in the face of unemployment challenges. During previous economic downturns, including the GFC and COVID-19 pandemic, property prices showed remarkable stability compared to other asset classes, particularly in metropolitan areas.

This counterintuitive resilience can be attributed to several factors: interest rate cuts typically accompany rising unemployment, offsetting affordability challenges; mortgage holders prioritise housing payments over other expenses; and property is viewed as a safe haven during economic uncertainty. While unemployment pressure may create headwinds, it’s unlikely to derail the current momentum in Australia’s housing market.

Interest rate cut to fuel further price growth

Today’s modest 0.25 per cent cut will still direct additional money into the housing market, providing borrowers with increased capacity. For a household with a $750,000 mortgage, this cut represents savings of approximately $115 per month.

Markets are now pricing in additional cuts through the remainder of the year, which will continue to support price growth. The impact will be particularly pronounced in markets that have already shown strong momentum, including Perth, Adelaide and Brisbane, where annual growth rates have reached 12.2 per cent, 7.8 per cent and 7.3 per cent respectively. However markets that are currently much slower, such as Sydney and Melbourne have historically been far more sensitive to rate cuts. The cuts today are likely to boost these markets.

Labor buyer-friendly policies adding additional fuel

The recent Labor victory in the federal election adds another dimension to Australia’s accelerating housing market. Labor’s comprehensive housing package, particularly the expansion of the five per cent deposit scheme to all first home buyers regardless of income.

This fundamental shift in housing accessibility will create additional demand pressure in a market already benefiting from interest rate reductions. By removing the substantial barrier of lenders’ mortgage insurance and the need for a 20 per cent deposit, more buyers will be able to enter the market simultaneously, competing for existing housing stock.

Safe haven in uncertain times

The combination of interest rate cuts, Labor’s buyer-friendly policies, and global economic uncertainty creates a perfect environment for accelerated price growth across Australia’s property markets. As financial markets worldwide experience turbulence from Trump’s “Liberation Day” tariffs, residential property offers distinct advantages:

- Greater price stability compared to share markets

- Tangible asset security with intrinsic utility value

- Immediate benefits from today’s interest rate cut

- Supply constraints supporting existing property values

While today’s rate cut provides immediate relief for mortgage holders, its impact on property prices will likely contribute to accelerating growth for the remainder of 2025.